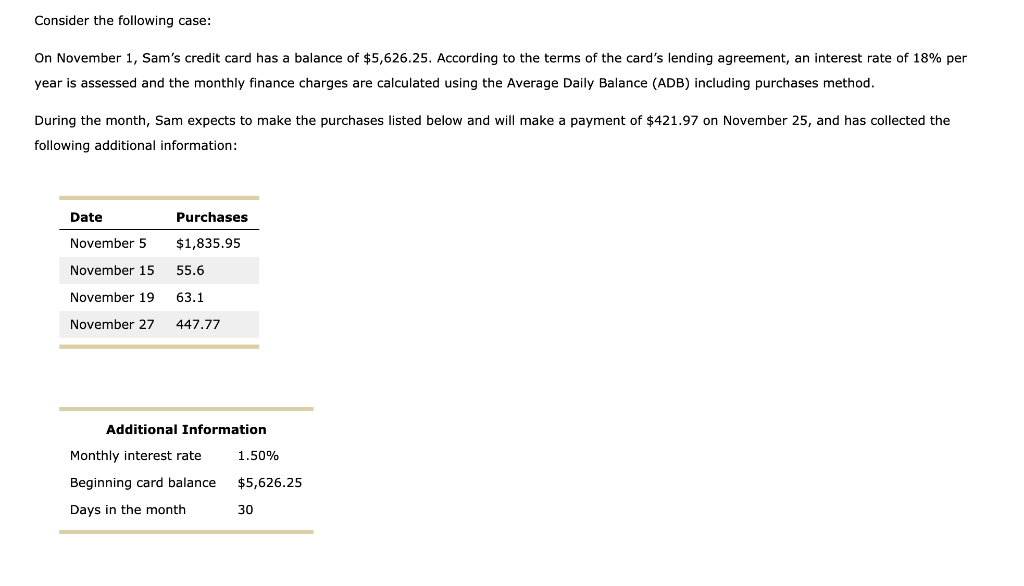

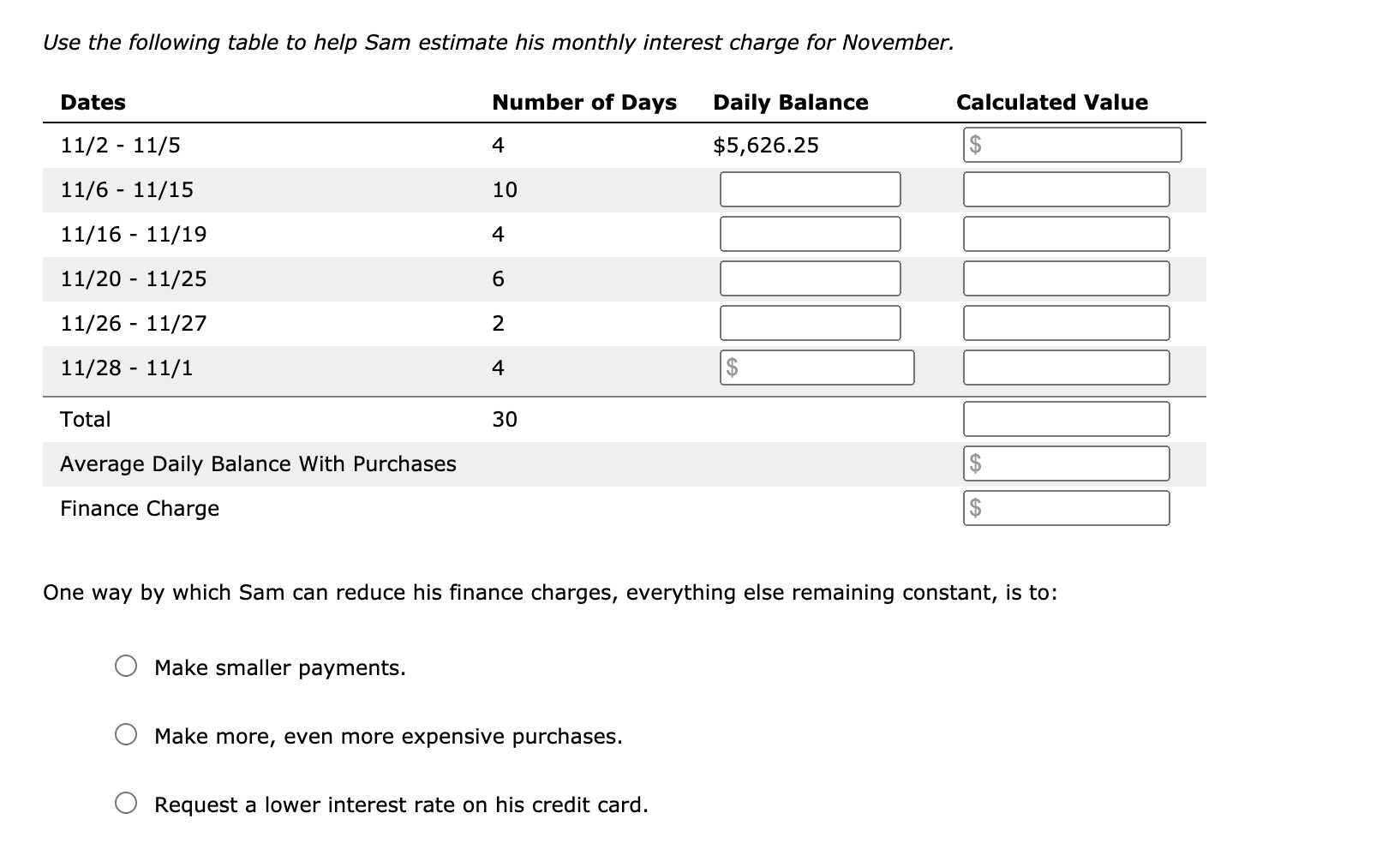

Consider the following case: On November 1, Sam's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 18% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Sam expects to make the purchases listed below and will make a payment of $421.97 on November 25, and has collected the following additional information: Date Purchases November 5 $1,835.95 November 15 55.6 November 19 63.1 November 27 447.77 Additional Information 1.50% Monthly interest rate Beginning card balance Days in the month $5,626.25 30 Use the following table to help Sam estimate his monthly interest charge for November. Dates Number of Days Daily Balance Calculated Value 11/2 - 11/5 4 $5,626.25 $ 11/6 - 11/15 10 11/16 - 11/19 4 11/20 - 11/25 6 11/26 - 11/27 2 11/28 - 11/1 4 $ Total 30 Average Daily Balance With Purchases $ Finance Charge One way by which Sam can reduce his finance charges, everything else remaining constant, is to: Make smaller payments. Make more, even more expensive purchases. Request a lower interest rate on his credit card. Consider the following case: On November 1, Sam's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 18% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Sam expects to make the purchases listed below and will make a payment of $421.97 on November 25, and has collected the following additional information: Date Purchases November 5 $1,835.95 November 15 55.6 November 19 63.1 November 27 447.77 Additional Information 1.50% Monthly interest rate Beginning card balance Days in the month $5,626.25 30 Use the following table to help Sam estimate his monthly interest charge for November. Dates Number of Days Daily Balance Calculated Value 11/2 - 11/5 4 $5,626.25 $ 11/6 - 11/15 10 11/16 - 11/19 4 11/20 - 11/25 6 11/26 - 11/27 2 11/28 - 11/1 4 $ Total 30 Average Daily Balance With Purchases $ Finance Charge One way by which Sam can reduce his finance charges, everything else remaining constant, is to: Make smaller payments. Make more, even more expensive purchases. Request a lower interest rate on his credit card