Answered step by step

Verified Expert Solution

Question

1 Approved Answer

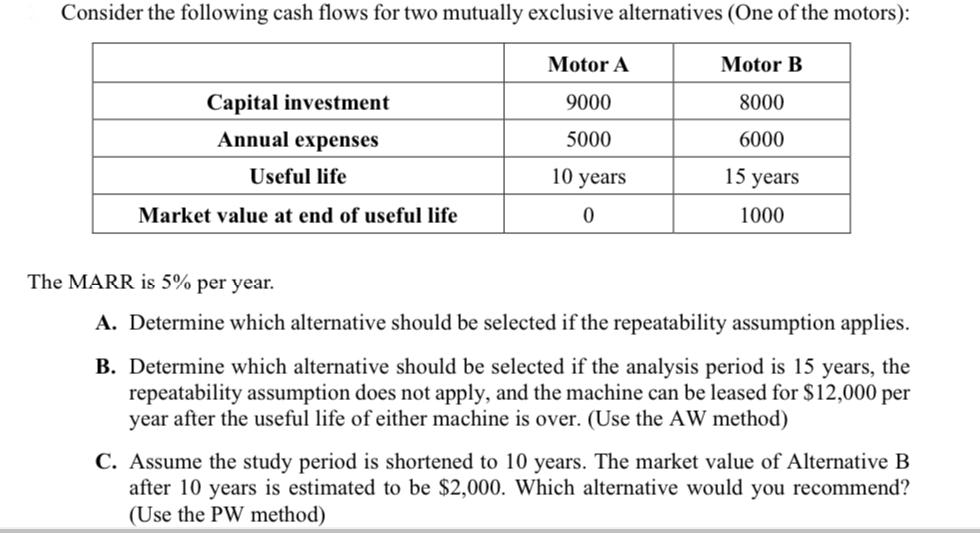

Consider the following cash flows for two mutually exclusive alternatives (One of the motors): Motor A Motor B Capital investment Annual expenses 9000 8000

Consider the following cash flows for two mutually exclusive alternatives (One of the motors): Motor A Motor B Capital investment Annual expenses 9000 8000 5000 6000 Useful life 10 years 15 years Market value at end of useful life 0 1000 The MARR is 5% per year. A. Determine which alternative should be selected if the repeatability assumption applies. B. Determine which alternative should be selected if the analysis period is 15 years, the repeatability assumption does not apply, and the machine can be leased for $12,000 per year after the useful life of either machine is over. (Use the AW method) C. Assume the study period is shortened to 10 years. The market value of Alternative B after 10 years is estimated to be $2,000. Which alternative would you recommend? (Use the PW method)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To determine which alternative should be selected if the repeatability assumption applies we need to calculate the present worth PW of each alternat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started