Question

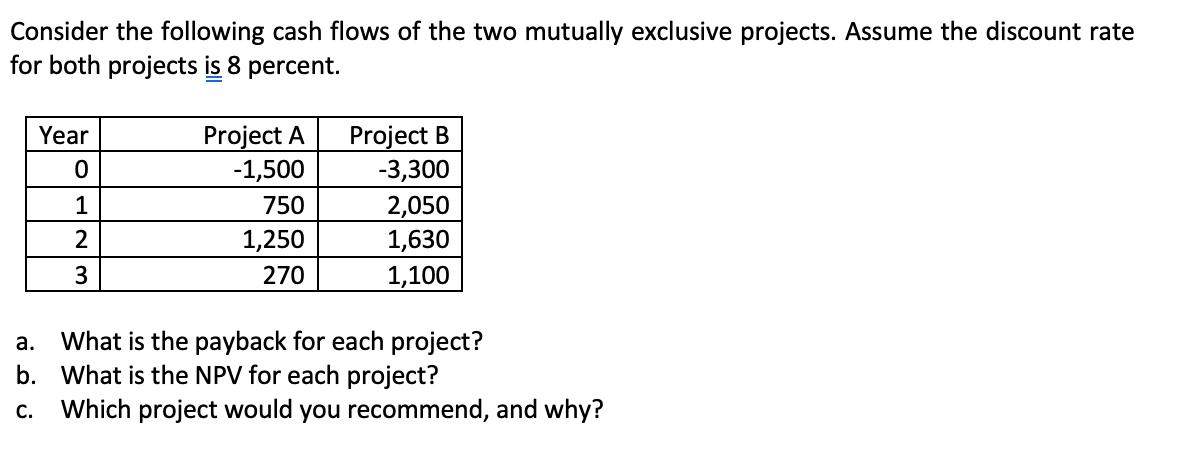

Consider the following cash flows of the two mutually exclusive projects. Assume the discount rate for both projects is 8 percent. Year 0 1

Consider the following cash flows of the two mutually exclusive projects. Assume the discount rate for both projects is 8 percent. Year 0 1 2 3 Project A -1,500 750 1,250 270 Project B -3,300 2,050 1,630 1,100 a. What is the payback for each project? b. What is the NPV for each project? C. Which project would you recommend, and why?

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the payback period for each project we need to determine the time it takes for the cumulative cash inflows to equal or exceed the initial investment For Project A Year 0 1500 Year 1 750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Finance The Logic and Practice of Financial Management

Authors: Arthur J. Keown, John D. Martin, J. William Petty

8th edition

132994879, 978-0132994873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App