Question

Consider the following cash flows on two mutually exclusive projects with similar risk for the Bahamas Recreation Corporation (BRC). BRC require an annual return

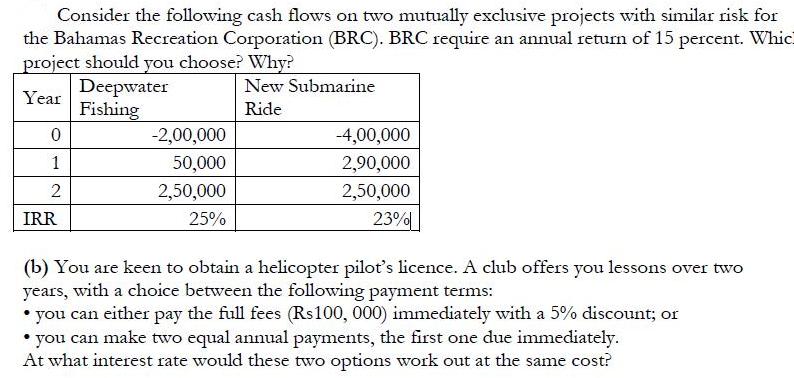

Consider the following cash flows on two mutually exclusive projects with similar risk for the Bahamas Recreation Corporation (BRC). BRC require an annual return of 15 percent. Whic project should you choose? Why? New Submarine Year Ride 0 1 2 IRR Deepwater Fishing -2,00,000 50,000 2,50,000 25% -4,00,000 2,90,000 2,50,000 23% (b) You are keen to obtain a helicopter pilot's licence. A club offers you lessons over two years, with a choice between the following payment terms: you can either pay the full fees (Rs100, 000) immediately with a 5% discount; or you can make two equal annual payments, the first one due immediately. At what interest rate would these two options work out at the same cost?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer So the int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App