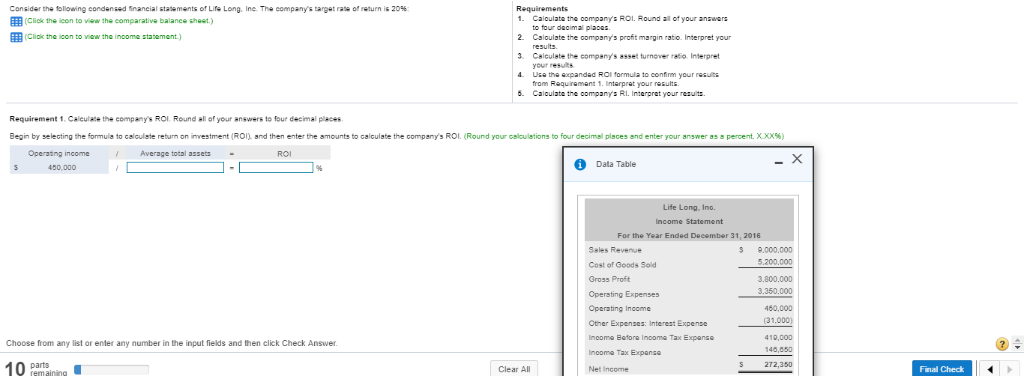

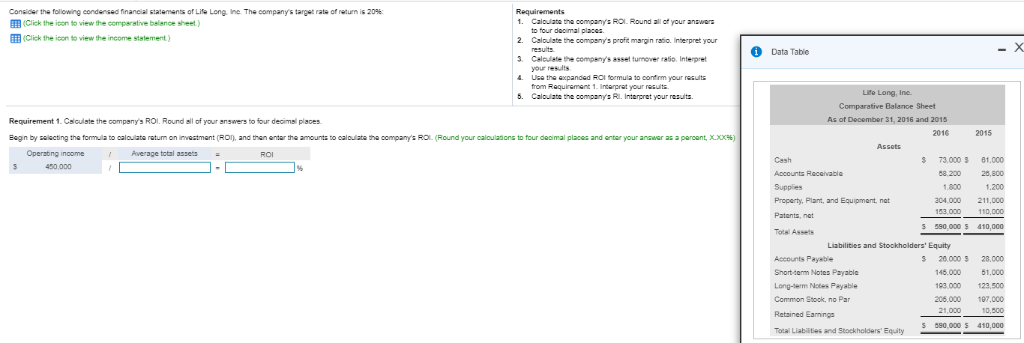

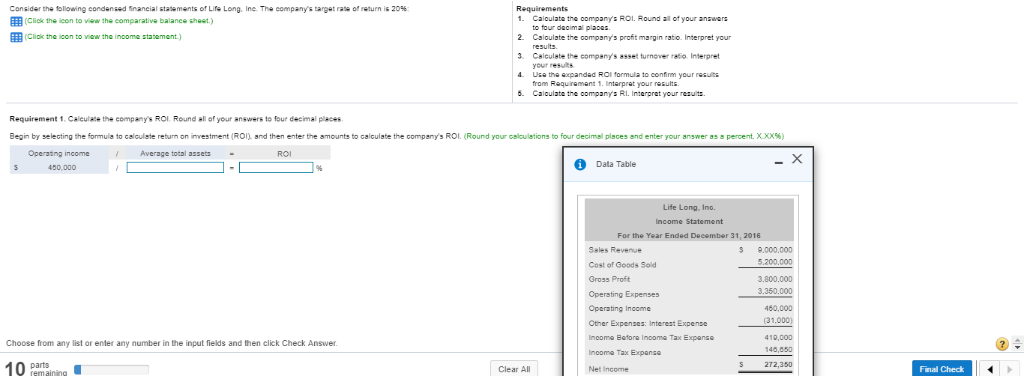

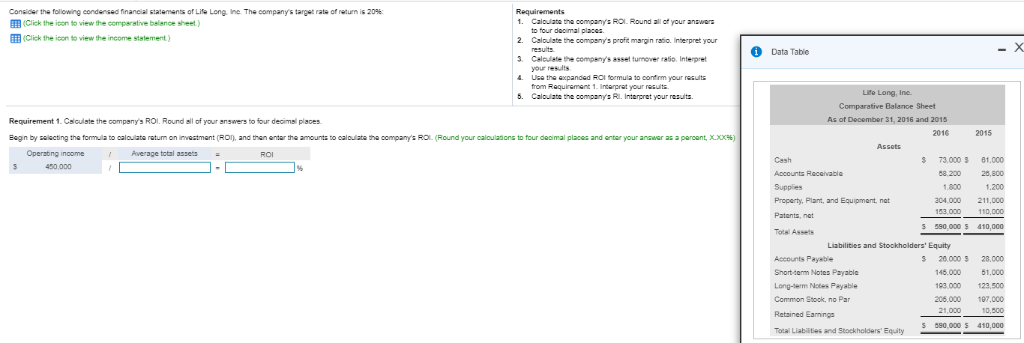

consider the following condensed financial statements of Life Long. Ine The company's target rate o, return is 20% EEE (Click the icon to view the comparative balancs shest.) EEE (Click the icon to vileww the income statement) 1. 2 Caloulate the company's profit margin rato. 3 Celculate the companys asset turnover ratio Interpret 4. Use the expandad ROl formula to confirm your reauits 6. Caloulate the oompanys Rl. Interpret your results Caloulate the oompanys ROL. Round all of your anawera Interpret your your resuts from Requiremant 1. Interpret your results Requirement 1. Caleulate the company's ROl. Round all of your answers to four decimal places Be n by selecting the for mule to calculete return on vest ent ROI) and the the amounts to calculate the company's ROI Round your calculations to our deca el places and enter your answer 85 percent XXX%) en Operating income Average total azsets ROI Data Table 450,000 Life Long, Ino For the Year Ended December 31, 2016 Sales Revenue Cost of Goods Sold Gross Proft Opersting Expenses Operating Income Other Expenses: Interest Expense noome Befora Income Tax Expense Income Tax Expense Net Income 5 9.000.000 5.200,000 3.800.000 3.350.000 460,000 (31.000) 410,000 140,050 Choose from any list or enter any number in the input fields and then click Check Answer Pamainin Clear All Final Check Consider the following condensed financial gatements of Life Long. ne The company's target rate onturn is 20% (Click the icon to view the comparative balance sheet ) 1. Caloulate the companys ROI Round ill o your anawer 2. Caloulate the company's profit margin ratio. Interpret your 3. Celoulate the company's asset turnover raso. Interpret to four deoimal placas. Click the icon to view the income statement) Data Table your results Ua the expanded ROi formula to contm your reult rom Requrement 1. Incarpret your reauits Lite Long, Inc. Comparative Balance Sheet As of December 31, 2016 and 2015 Caloulate the companys Ri. Interpret your resuits Requirement 1. Cslculste the company's ROl. Round all of your answers to four decimal places 2010 2015 Begn by palecting tha formula to oal late ratum on nveatment (ROD, and then entar the amourts to oalaate tha oompany's RO (Round your calouladons to tur decimal places and enter your anawer as a percent, X.XX%) Operating income 450,000 Average total asses Cash Accounts Racavabla Supplies Property, Plant, and Equipment, net Patants, net Totsl Assets S 73.000 61,000 08,200 20,800 1.200 304,000 211,00O 1.800 590 000 410,000 Liabilities and Stookholders' Equity Accounts Payabe Shortterm Notes Payabie Long-lerm Notes Payable Common Stook, no Par Retained Earnings S 20.000 28.000 146.000 51.000 93.000 123,500 206,000 1,000 10,500 S 580,000 410,000 consider the following condensed financial statements of Life Long. Ine The company's target rate o, return is 20% EEE (Click the icon to view the comparative balancs shest.) EEE (Click the icon to vileww the income statement) 1. 2 Caloulate the company's profit margin rato. 3 Celculate the companys asset turnover ratio Interpret 4. Use the expandad ROl formula to confirm your reauits 6. Caloulate the oompanys Rl. Interpret your results Caloulate the oompanys ROL. Round all of your anawera Interpret your your resuts from Requiremant 1. Interpret your results Requirement 1. Caleulate the company's ROl. Round all of your answers to four decimal places Be n by selecting the for mule to calculete return on vest ent ROI) and the the amounts to calculate the company's ROI Round your calculations to our deca el places and enter your answer 85 percent XXX%) en Operating income Average total azsets ROI Data Table 450,000 Life Long, Ino For the Year Ended December 31, 2016 Sales Revenue Cost of Goods Sold Gross Proft Opersting Expenses Operating Income Other Expenses: Interest Expense noome Befora Income Tax Expense Income Tax Expense Net Income 5 9.000.000 5.200,000 3.800.000 3.350.000 460,000 (31.000) 410,000 140,050 Choose from any list or enter any number in the input fields and then click Check Answer Pamainin Clear All Final Check Consider the following condensed financial gatements of Life Long. ne The company's target rate onturn is 20% (Click the icon to view the comparative balance sheet ) 1. Caloulate the companys ROI Round ill o your anawer 2. Caloulate the company's profit margin ratio. Interpret your 3. Celoulate the company's asset turnover raso. Interpret to four deoimal placas. Click the icon to view the income statement) Data Table your results Ua the expanded ROi formula to contm your reult rom Requrement 1. Incarpret your reauits Lite Long, Inc. Comparative Balance Sheet As of December 31, 2016 and 2015 Caloulate the companys Ri. Interpret your resuits Requirement 1. Cslculste the company's ROl. Round all of your answers to four decimal places 2010 2015 Begn by palecting tha formula to oal late ratum on nveatment (ROD, and then entar the amourts to oalaate tha oompany's RO (Round your calouladons to tur decimal places and enter your anawer as a percent, X.XX%) Operating income 450,000 Average total asses Cash Accounts Racavabla Supplies Property, Plant, and Equipment, net Patants, net Totsl Assets S 73.000 61,000 08,200 20,800 1.200 304,000 211,00O 1.800 590 000 410,000 Liabilities and Stookholders' Equity Accounts Payabe Shortterm Notes Payabie Long-lerm Notes Payable Common Stook, no Par Retained Earnings S 20.000 28.000 146.000 51.000 93.000 123,500 206,000 1,000 10,500 S 580,000 410,000