Question

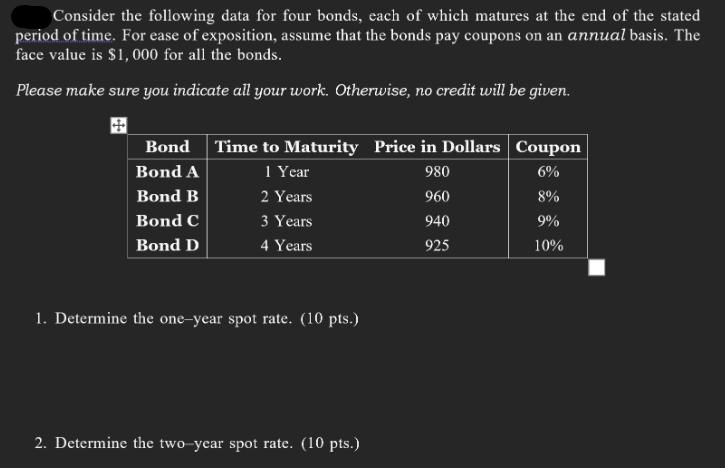

Consider the following data for four bonds, each of which matures at the end of the stated period of time. For ease of exposition,

Consider the following data for four bonds, each of which matures at the end of the stated period of time. For ease of exposition, assume that the bonds pay coupons on an annual basis. The face value is $1,000 for all the bonds. Please make sure you indicate all your work. Otherwise, no credit will be given. Bond Time to Maturity Price in Dollars Bond A 1 Year 980 Bond B 2 Years 960 Bond C 3 Years 940 Bond D 4 Years 925 1. Determine the one-year spot rate. (10 pts.) 2. Determine the two-year spot rate. (10 pts.) Coupon 6% 8% 9% 10%

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the spot rates for each year we can use the bond prices and coupon payments to solve fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting for Governmental and Nonprofit Entities

Authors: Earl R. Wilson, Jacqueline L Reck, Susan C Kattelus

15th Edition

978-0256168723, 77388720, 256168725, 9780077388720, 978-007337960

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App