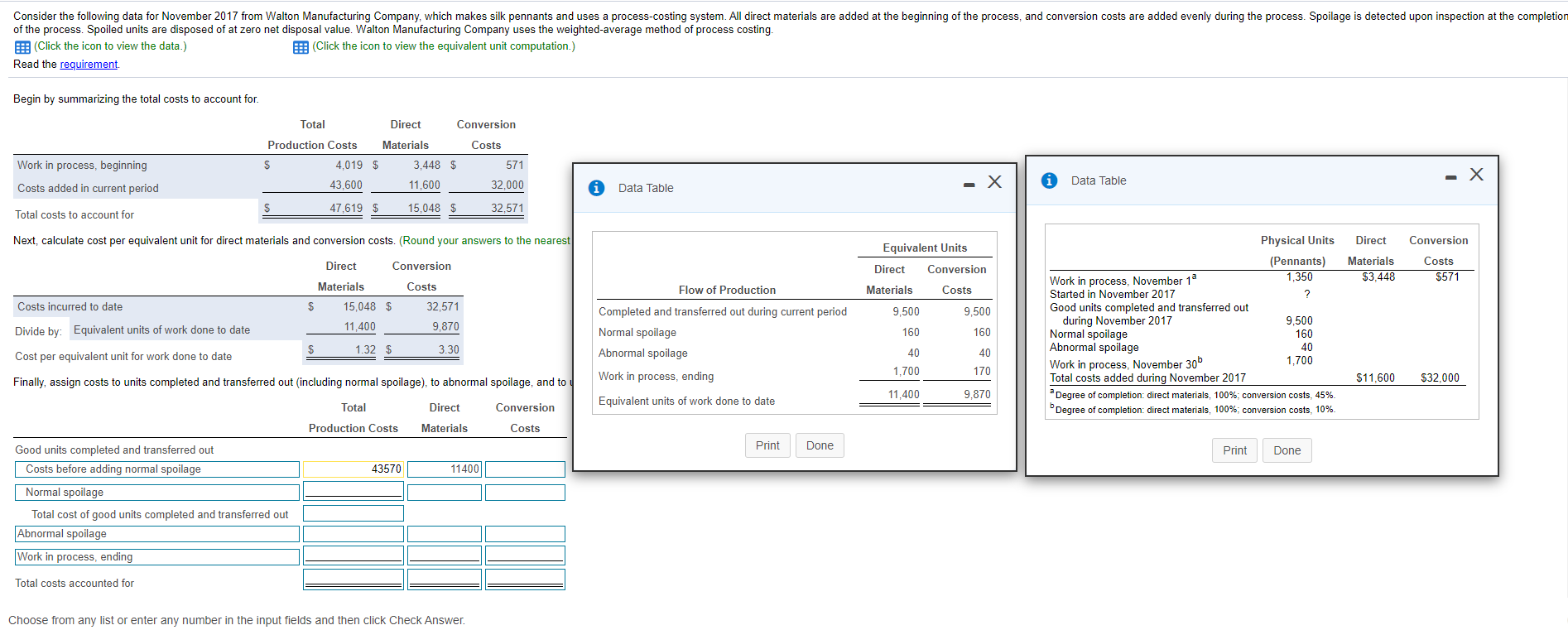

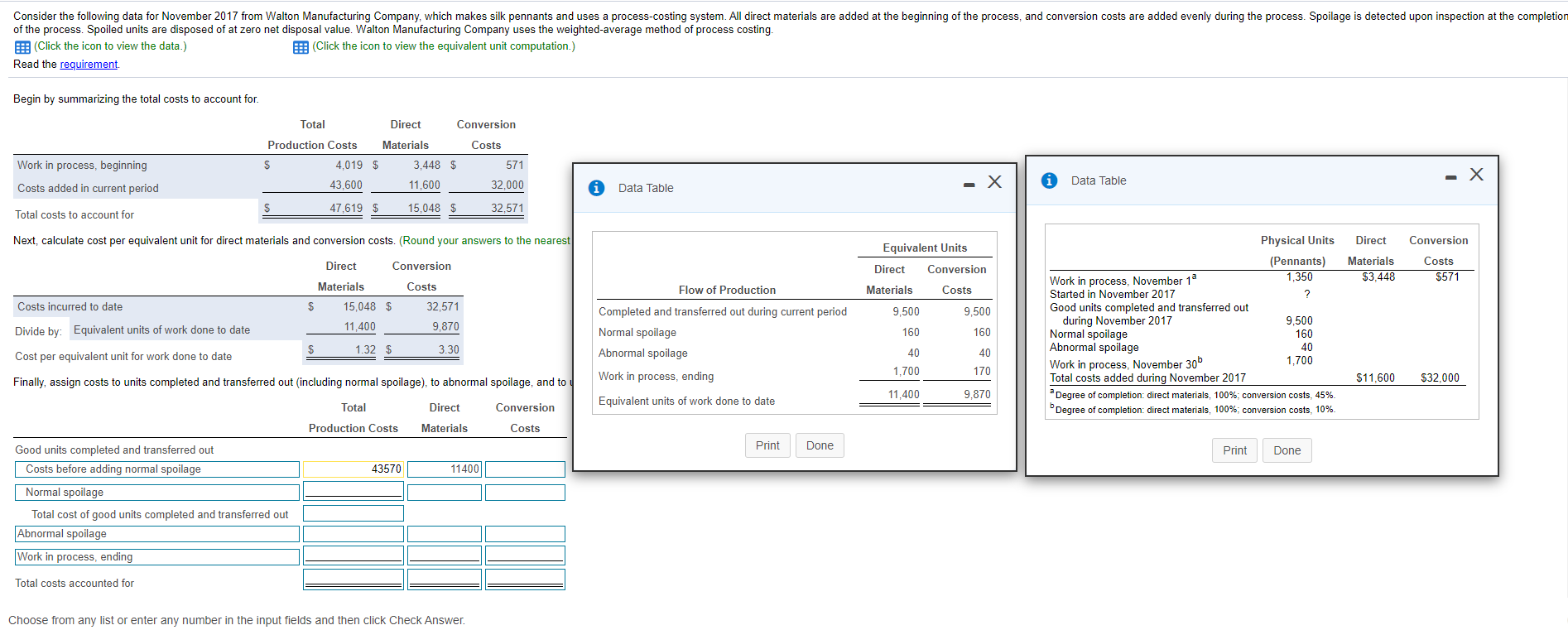

Consider the following data for November 2017 from Walton Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. Walton Manufacturing Company uses the weighted-average method of process costing. e Click the icon to view the data.) (Click the icon to view the equivalent unit computation.) Read the requirement Begin by summarizing the total costs to account for Total Direct Conversion Production Costs Materials Costs $ 4,019 $ 3,448 $ 571 43,600 11,600 32.000 Work in process, beginning Costs added in current period - X Data Table - X Data Table 47,619 $ 15.048 $ 32,571 Total costs to account for Next, calculate cost per equivalent unit for direct materials and conversion costs. (Round your answers to the nearest Direct Conversion Equivalent Units Direct Conversion Direct Conversion Materials $3,448 Costs $571 Materials Costs Flow of Production Materials Costs 9,500 9,500 160 Physical Units (Pennants) Work in process, November 1a 1,350 Started in November 2017 ? Good units completed and transferred out during November 2017 9,500 Normal spoilage 160 Abnormal spoilage 40 1.700 Work in process, November 300 Total costs added during November 2017 Degree of completion direct materials, 100%; conversion costs, 45%. Degree of completion: direct materials, 100%; conversion costs, 10%. Completed and transferred out during current period Normal spoilage Abnormal spoilage Work in process, ending 160 40 40 1,700 170 $11,600 $32,000 11,400 9,870 Equivalent units of work done to date Costs incurred to date $ 15,048 $ 32,571 Divide by: Equivalent units of work done to date 11,400 9.870 1.32 $ 3.30 Cost per equivalent unit for work done to date Finally, gn costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to Total Direct Conversion Production Costs Materials Costs Good units completed and transferred out Costs before adding normal spoilage 43570 11400 Normal spoilage Total cost of good units completed and transferred out Abnormal spoilage Work in process, ending Print Done Print Done Total costs accounted for Choose from any list or enter any number in the input fields and then click Check Answer. Consider the following data for November 2017 from Walton Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. Walton Manufacturing Company uses the weighted-average method of process costing. e Click the icon to view the data.) (Click the icon to view the equivalent unit computation.) Read the requirement Begin by summarizing the total costs to account for Total Direct Conversion Production Costs Materials Costs $ 4,019 $ 3,448 $ 571 43,600 11,600 32.000 Work in process, beginning Costs added in current period - X Data Table - X Data Table 47,619 $ 15.048 $ 32,571 Total costs to account for Next, calculate cost per equivalent unit for direct materials and conversion costs. (Round your answers to the nearest Direct Conversion Equivalent Units Direct Conversion Direct Conversion Materials $3,448 Costs $571 Materials Costs Flow of Production Materials Costs 9,500 9,500 160 Physical Units (Pennants) Work in process, November 1a 1,350 Started in November 2017 ? Good units completed and transferred out during November 2017 9,500 Normal spoilage 160 Abnormal spoilage 40 1.700 Work in process, November 300 Total costs added during November 2017 Degree of completion direct materials, 100%; conversion costs, 45%. Degree of completion: direct materials, 100%; conversion costs, 10%. Completed and transferred out during current period Normal spoilage Abnormal spoilage Work in process, ending 160 40 40 1,700 170 $11,600 $32,000 11,400 9,870 Equivalent units of work done to date Costs incurred to date $ 15,048 $ 32,571 Divide by: Equivalent units of work done to date 11,400 9.870 1.32 $ 3.30 Cost per equivalent unit for work done to date Finally, gn costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to Total Direct Conversion Production Costs Materials Costs Good units completed and transferred out Costs before adding normal spoilage 43570 11400 Normal spoilage Total cost of good units completed and transferred out Abnormal spoilage Work in process, ending Print Done Print Done Total costs accounted for Choose from any list or enter any number in the input fields and then click Check