Question

Consider the following data on two government bonds that pay interest semi-annually on $100 face value. Bond A Bond B Coupon 8% 9% Yield

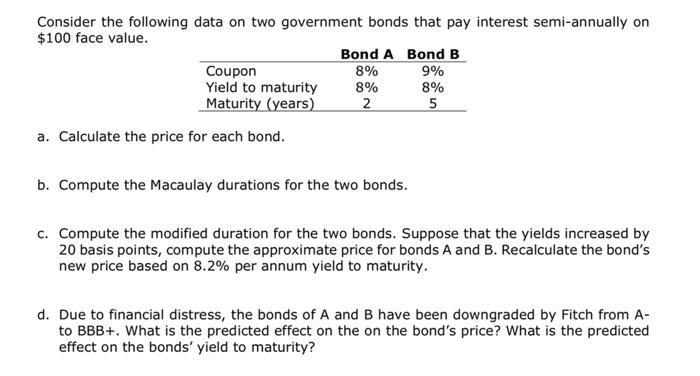

Consider the following data on two government bonds that pay interest semi-annually on $100 face value. Bond A Bond B Coupon 8% 9% Yield to maturity 8% 8% Maturity (years) 2 5 a. Calculate the price for each bond. b. Compute the Macaulay durations for the two bonds. c. Compute the modified duration for the two bonds. Suppose that the yields increased by 20 basis points, compute the approximate price for bonds A and B. Recalculate the bond's new price based on 8.2% per annum yield to maturity. d. Due to financial distress, the bonds of A and B have been downgraded by Fitch from A- to BBB+. What is the predicted effect on the on the bond's price? What is the predicted effect on the bonds' yield to maturity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

3rd edition

9780077506902, 78025540, 77506901, 978-0078025549

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App