Question

Consider the following data towards a firm's potential leverage. Assume that the firm can lever up in increments of 10% of firm value upto

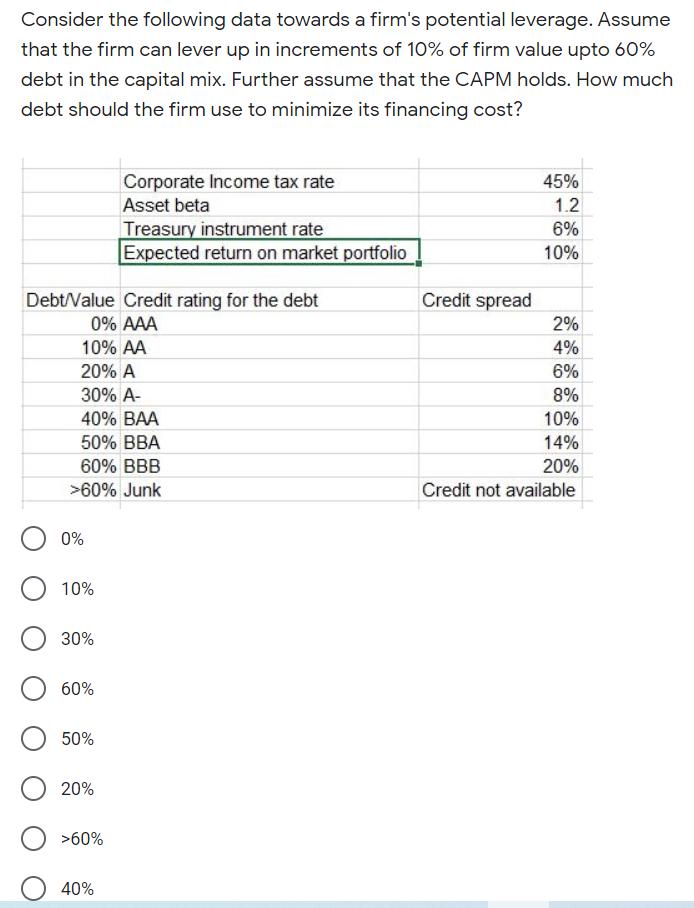

Consider the following data towards a firm's potential leverage. Assume that the firm can lever up in increments of 10% of firm value upto 60% debt in the capital mix. Further assume that the CAPM holds. How much debt should the firm use to minimize its financing cost? Debt/Value Credit rating for the debt 0% AAA 10% AA 20% A 30% A- 40% BAA 50% BBA 60% BBB >60% Junk 0% 10% 30% 60% 50% 20% Corporate Income tax rate Asset beta Treasury instrument rate Expected return on market portfolio O >60% 40% Credit spread 45% 1.2 6% 10% 2% 4% 6% 8% 10% 14% 20% Credit not available

Step by Step Solution

3.89 Ratings (9 Votes)

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

978-0132554909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Study smarter with the SolutionInn App