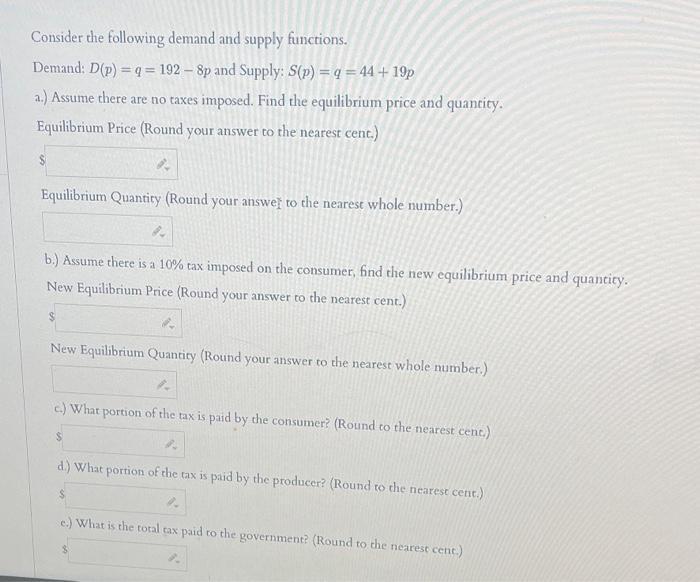

Question: Consider the following demand and supply functions. Demand: D(p) = q = 192 - 8p and Supply: S(p) = q = 44+ 19p a.)

Consider the following demand and supply functions. Demand: D(p) = q = 192 - 8p and Supply: S(p) = q = 44+ 19p a.) Assume there are no taxes imposed. Find the equilibrium price and quantity. Equilibrium Price (Round your answer to the nearest cent.) Equilibrium Quantity (Round your answer to the nearest whole number.) 42 b.) Assume there is a 10% tax imposed on the consumer, find the new equilibrium price and quantity. New Equilibrium Price (Round your answer to the nearest cent.) $ New Equilibrium Quantity (Round your answer to the nearest whole number.) 1. c.) What portion of the tax is paid by the consumer? (Round to the nearest cent.) $ d.) What portion of the tax is paid by the producer? (Round to the nearest cent.) e.) What is the total tax paid to the government? (Round to the nearest cent.)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

The image shows a set of questions relating to economics specifically dealing with the determination of equilibrium price and quantity along with anal... View full answer

Get step-by-step solutions from verified subject matter experts