Question

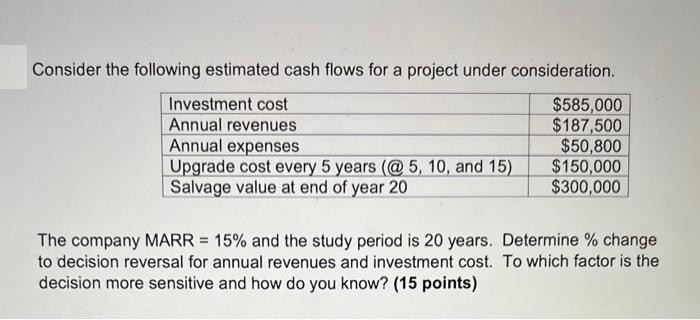

Consider the following estimated cash flows for a project under consideration. $585,000 $187,500 $50,800 Investment cost Annual revenues Annual expenses Upgrade cost every 5

Consider the following estimated cash flows for a project under consideration. $585,000 $187,500 $50,800 Investment cost Annual revenues Annual expenses Upgrade cost every 5 years (@5, 10, and 15) Salvage value at end of year 20 $150,000 $300,000 The company MARR = 15% and the study period is 20 years. Determine % change to decision reversal for annual revenues and investment cost. To which factor is the decision more sensitive and how do you know? (15 points)

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine the change to decision reversal for annual revenues and investment cost we need to calculate the net present value NPV of the project using the given information and the companys minimum ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App