Answered step by step

Verified Expert Solution

Question

1 Approved Answer

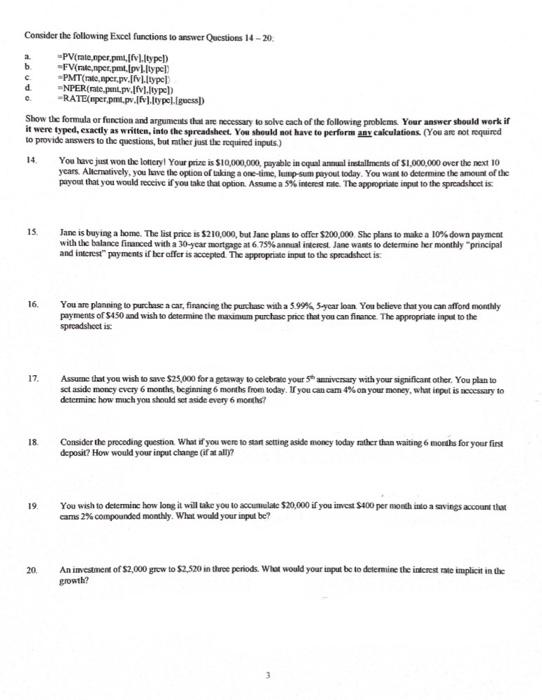

Consider the following Excel functions to answer Questions 14 - 20: b. a. =PV(rate,nper.pmt, [fv),[type]) -FV(rate,nper.pmt,[pv],[type]) =PMT(rate,nper.pv.[fv].[type]) d. =NPER(rate,pint.pv.[fv].[type]) =RATE(nper.pmt.pv.[fv).[type].[guess]) C. e. Show the formula

Consider the following Excel functions to answer Questions 14 - 20: b. a. =PV(rate,nper.pmt, [fv),[type]) -FV(rate,nper.pmt,[pv],[type]) =PMT(rate,nper.pv.[fv].[type]) d. =NPER(rate,pint.pv.[fv].[type]) =RATE(nper.pmt.pv.[fv).[type].[guess]) C. e. Show the formula or function and arguments that are necessary to solve each of the following problems. Your answer should work if it were typed, exactly as written, into the spreadsheet. You should not have to perform any calculations. (You are not required to provide answers to the questions, but rather just the required inputs.) 14. 15. 16. 17. 18. 19. 20. You have just won the lottery! Your prize is $10,000,000, payable in equal annual installments of $1,000,000 over the next 10 years. Alternatively, you have the option of taking a one-time, lump-sum payout today. You want to determine the amount of the payout that you would receive if you take that option. Assume a 5% interest rate. The appropriate input to the spreadsheet is: Jane is buying a home. The list price is $210,000, but Jane plans to offer $200,000. She plans to make a 10% down payment with the balance financed with a 30-year mortgage at 6.75% annual interest. Jane wants to determine her monthly "principal and interest" payments if her offer is accepted. The appropriate input to the spreadsheet is: You are planning to purchase a car, financing the purchase with a 5.99%, 5-year loan. You believe that you can afford monthly payments of $450 and wish to determine the maximum purchase price that you can finance. The appropriate input to the spreadsheet is: Assume that you wish to save $25,000 for a getaway to celebrate your 5th anniversary with your significant other. You plan to set aside money every 6 months, beginning 6 months from today. If you can cam 4% on your money, what input is necessary to determine how much you should set aside every 6 months? Consider the preceding question. What if you were to start setting aside money today rather than waiting 6 months for your first deposit? How would your input change (if at all)? You wish to determine how long it will take you to accumulate $20,000 if you invest $400 per month into a savings account that cams 2% compounded monthly. What would your input be? An investment of $2,000 grew to $2,520 in three periods. What would your input be to determine the interest rate implicit in the growth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started