Answered step by step

Verified Expert Solution

Question

1 Approved Answer

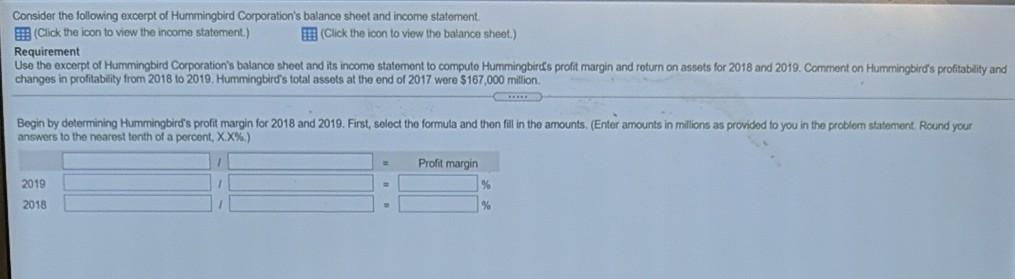

Consider the following excerpt of Hummingbird Corporation's balance sheet and income statement, E (Click the icon to view the income statement.) (Click the icon to

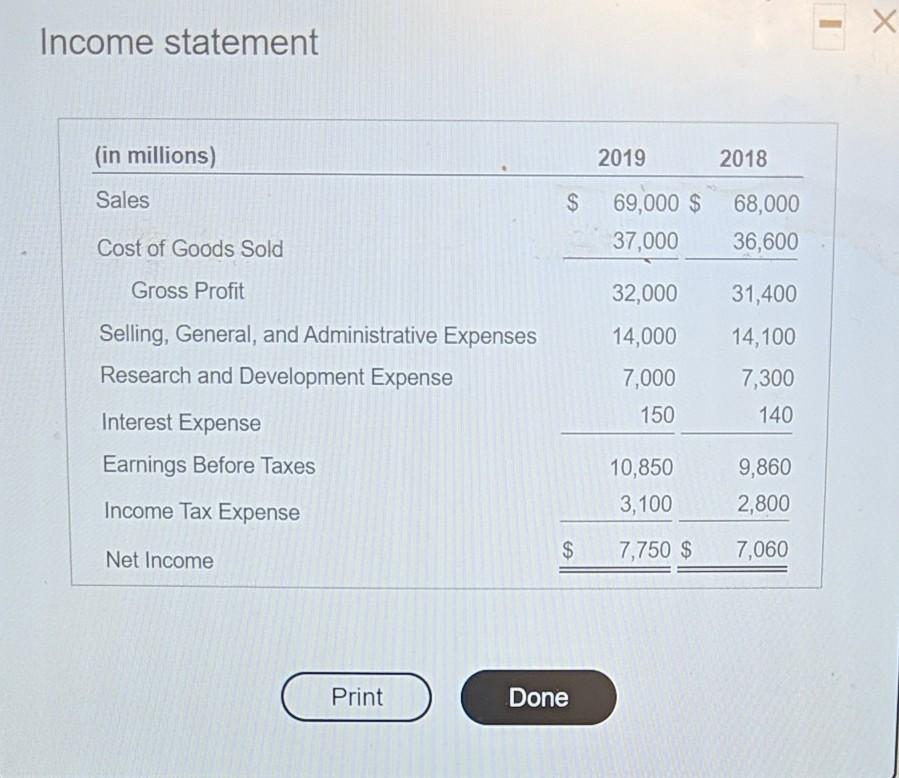

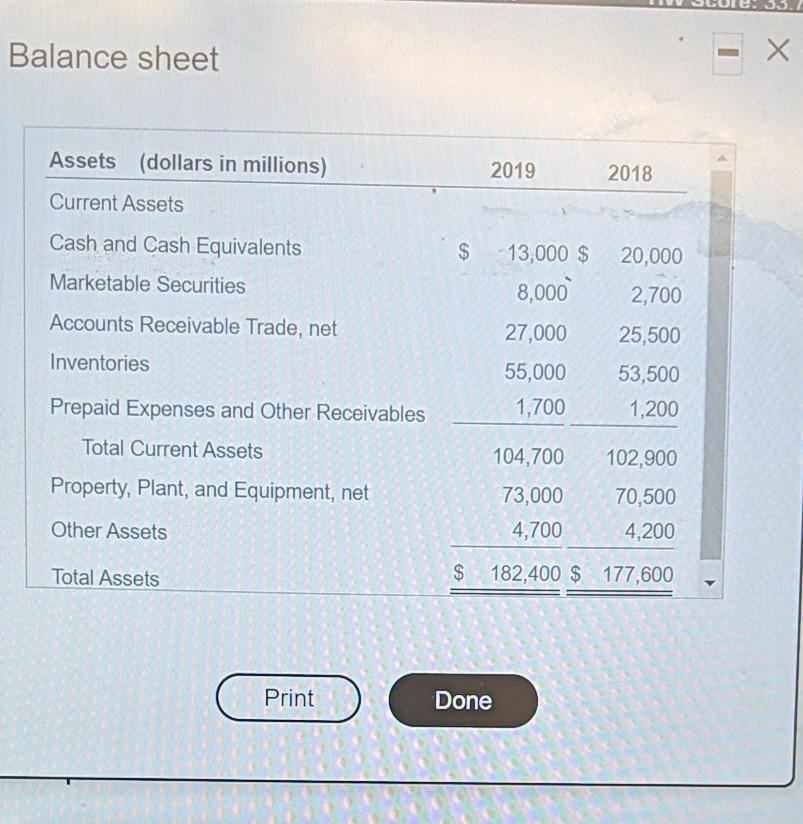

Consider the following excerpt of Hummingbird Corporation's balance sheet and income statement, E (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) Requirement Use the excerpt of Hummingbird Corporation's balance sheet and its income statement to computo Hummingbird's profit margin and return on assets for 2018 and 2019. Comment on Hummingbird's profitability and changes in profitability from 2018 to 2019. Hummingbird's total assets at the end of 2017 were $167.000 million Begin by determining Hummingbird's profit margin for 2018 and 2019. First, soloct tho formula and then fill in the amounts. (Enter amounts answers to the nearest tenth of a percent, XX%) millions as provided to you in the problem statement Round your Profit margin 2019 2018 Income statement (in millions) 2019 2018 Sales $ 69,000 $ 37,000 68,000 36,600 Cost of Goods Sold Gross Profit 32,000 14,000 Selling, General, and Administrative Expenses Research and Development Expense Interest Expense Earnings Before Taxes 31,400 14,100 7,300 140 7,000 150 10,850 3,100 9,860 2,800 Income Tax Expense $ Net Income 7,750 $ 7,060 Print Done Balance sheet Assets (dollars in millions) 2019 2018 Current Assets Cash and Cash Equivalents Marketable Securities $ 13,000 $ 8,000 20,000 2,700 Accounts Receivable Trade, net 27,000 25,500 Inventories 55,000 1,700 53,500 1,200 Prepaid Expenses and Other Receivables Total Current Assets 104,700 102,900 Property, Plant, and Equipment, net 73,000 4,700 70,500 4,200 Other Assets Total Assets $ 182,400 $ 177,600 C Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started