Question

Consider the following expected net cash flows for a project: Year 0 1 2 3 4 5 Expected NCF $(100,000) 80,000 60,000 70,000 10,000

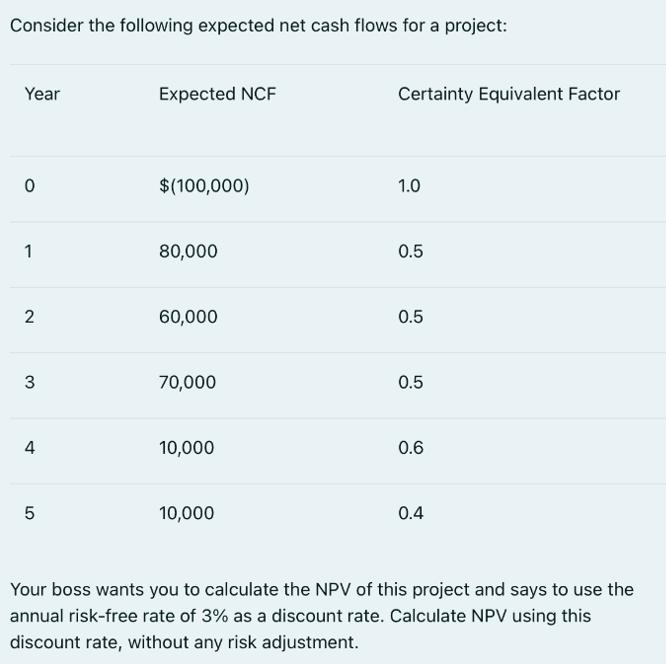

Consider the following expected net cash flows for a project: Year 0 1 2 3 4 5 Expected NCF $(100,000) 80,000 60,000 70,000 10,000 10,000 Certainty Equivalent Factor 1.0 0.5 0.5 0.5 0.6 0.4 Your boss wants you to calculate the NPV of this project and says to use the annual risk-free rate of 3% as a discount rate. Calculate NPV using this discount rate, without any risk adjustment.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

YEAR CASH FLOW CERTAINITY EQUIVALENT CE CASH FLOW CE 1 3 n PRESENT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App