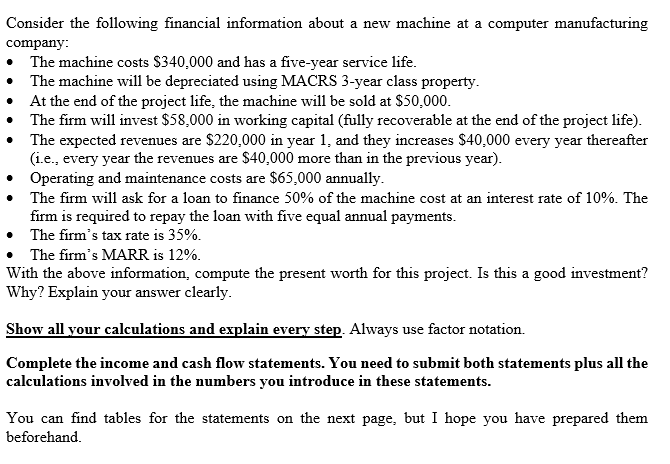

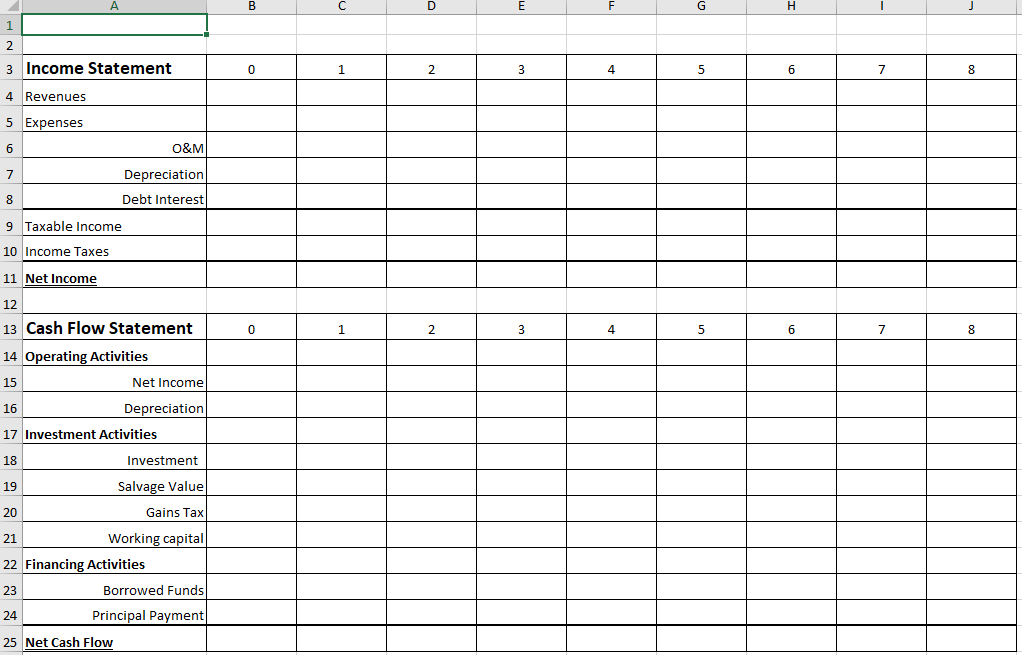

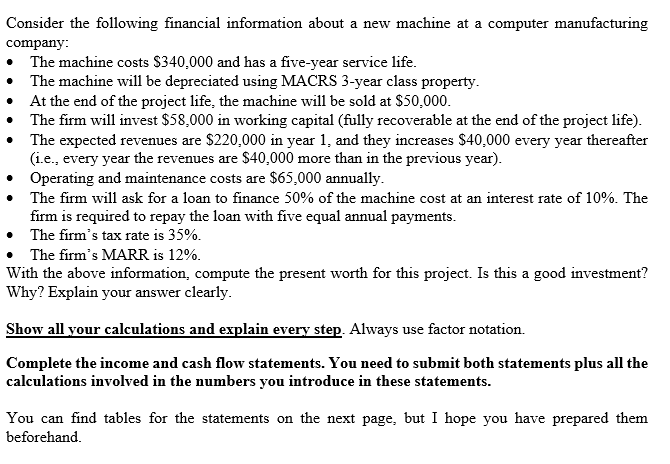

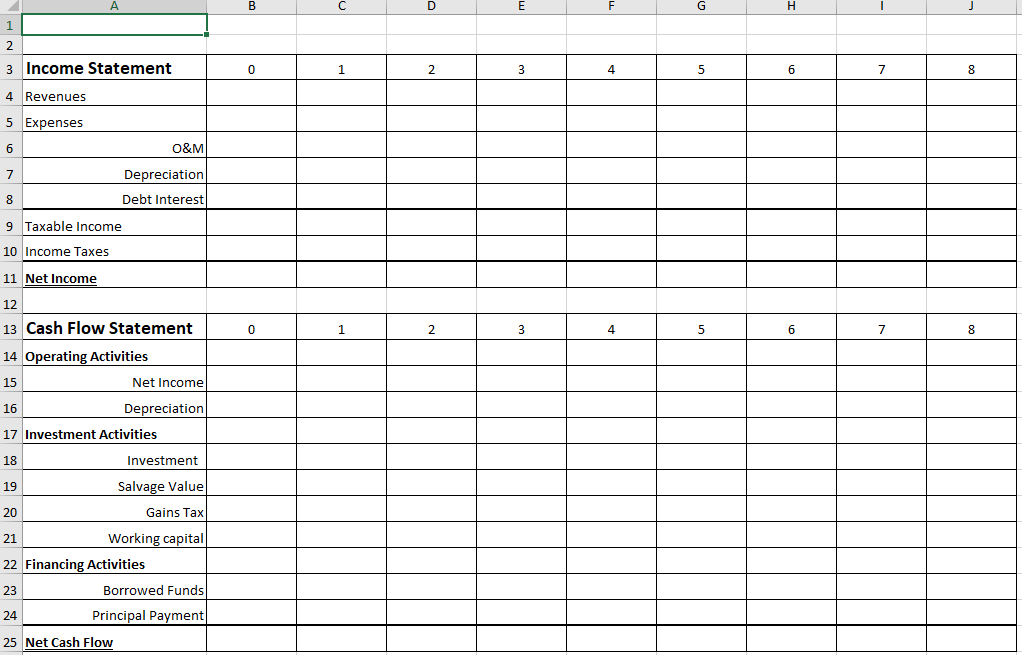

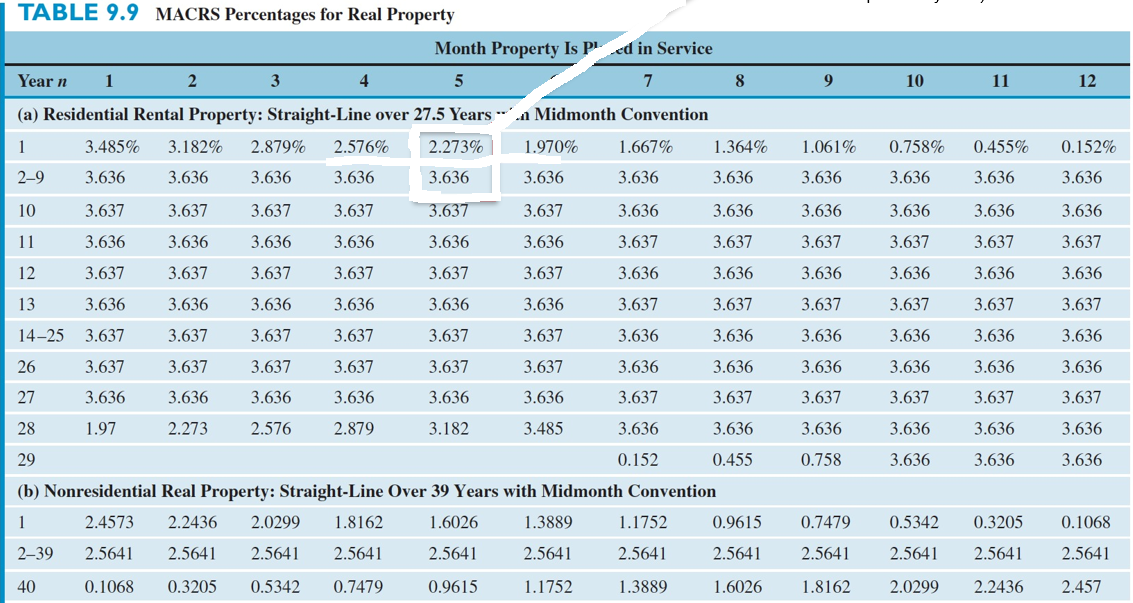

. Consider the following financial information about a new machine at a computer manufacturing company: The machine costs $340,000 and has a five-year service life. The machine will be depreciated using MACRS 3-year class property. At the end of the project life, the machine will be sold at $50,000. The firm will invest $58,000 in working capital (fully recoverable at the end of the project life). The expected revenues are $220,000 in year 1, and they increases $40.000 every year thereafter (1.e., every year the revenues are $40,000 more than in the previous year). Operating and maintenance costs are $65,000 annually. The firm will ask for a loan to finance 50% of the machine cost at an interest rate of 10%. The firm is required to repay the loan with five equal annual payments. The firm's tax rate is 35%. The firm's MARR is 12%. With the above information, compute the present worth for this project. Is this a good investment? Why? Explain your answer clearly. Show all your calculations and explain every step. Always use factor notation Complete the income and cash flow statements. You need to submit both statements plus all the calculations involved in the numbers you introduce in these statements. You can find tables for the statements on the next page, but I hope you have prepared them beforehand. G H 1 2 3 Income Statement 0 1 2 3 4 5 6 7 8 4 Revenues 5 Expenses 6 O&M 7 Depreciation Debt Interest 8 9 Taxable income 10 Income Taxes 11 Net Income 12 13 Cash Flow Statement 14 Operating Activities 0 1 2 3 4 5 6 7 15 Net Income 16 Depreciation 17 Investment Activities 18 Investment 19 Salvage Value 20 Gains Tax 21 Working capital 22 Financing Activities 23 Borrowed Funds 24 Principal Payment 25 Net Cash Flow TABLE 9.6 MACRS Depreciation Schedules for Personal Properties with Half-Year Convention, Declining-Balance Method Class 3 5 7 10 15 20 Depreciation Rate Year n 200% 200% 200% 200% 150% 150% 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81* 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 5 11.52 8.93* 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462* 10 6.55 5.90 4.461 11 3.28 5.91 4.462 TABLE 9.9 MACRS Percentages for Real Property Month Property Is Pled in Service Year n 2 3 4 5 1 8 9 10 11 12 (a) Residential Rental Property: Straight-Line over 27.5 Years Midmonth Convention 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 2-9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 1 1.061% 0.758% 0.455% 0.152% 3.636 3.636 3.636 3.636 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 12 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 3.637 13 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 14-25 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 26 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.636 27 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 28 1.97 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 29 0.152 0.455 0.758 3.636 3.636 3.636 (b) Nonresidential Real Property: Straight-Line Over 39 Years with Midmonth Convention 2.4573 2.2436 2.0299 1.8162 1.6026 1.3889 1.1752 0.9615 1 0.7479 0.5342 0.3205 0.1068 2-39 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 2.5641 40 0.1068 0.3205 0.5342 0.7479 0.9615 1.1752 1.3889 1.6026 1.8162 2.0299 2.2436 2.457