Answered step by step

Verified Expert Solution

Question

1 Approved Answer

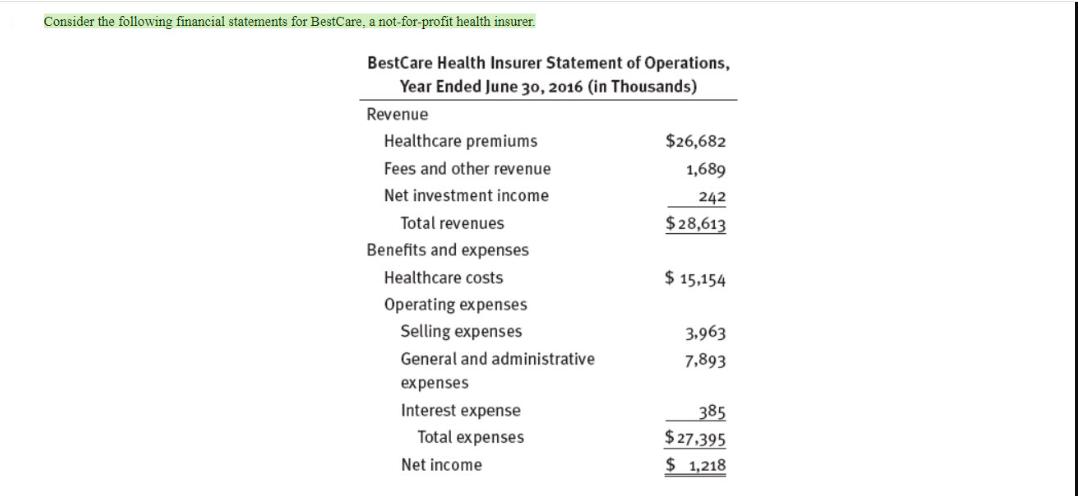

Consider the following financial statements for BestCare, a not-for-profit health insurer. BestCare Health Insurer Statement of Operations, Year Ended June 30, 2016 (in Thousands)

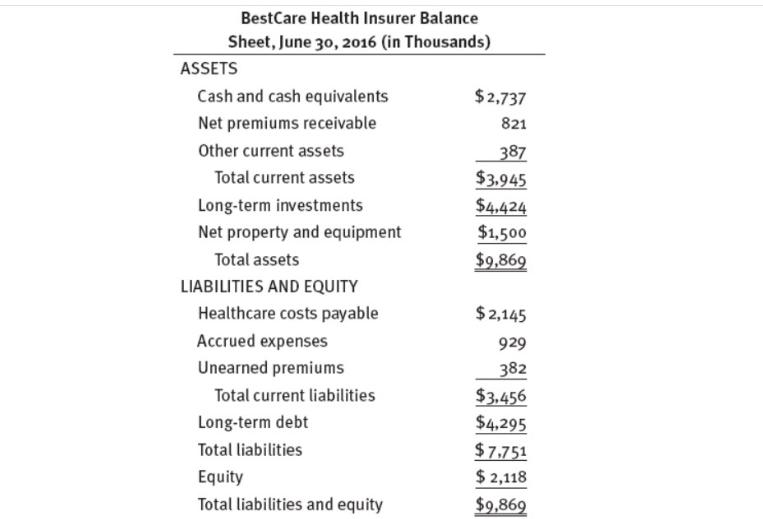

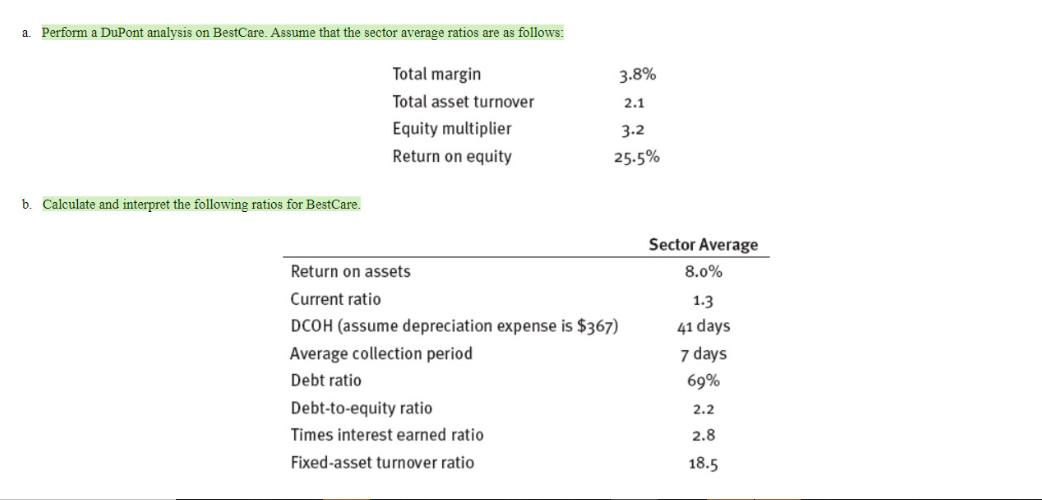

Consider the following financial statements for BestCare, a not-for-profit health insurer. BestCare Health Insurer Statement of Operations, Year Ended June 30, 2016 (in Thousands) Revenue Healthcare premiums $26,682 Fees and other revenue 1,689 Net investment income 242 Total revenues $28,613 Benefits and expenses Healthcare costs $ 15,154 Operating expenses Selling expenses 3.963 General and administrative 7,893 expenses Interest expense 385 Total expenses $27.395 Net income $ 1,218 BestCare Health Insurer Balance Sheet, June 30, 2016 (in Thousands) ASSETS Cash and cash equivalents $2,737 Net premiums receivable 821 Other current assets 387 Total current assets $3.945 Long-term investments $4.424 Net property and equipment $1,500 Total assets $9,869 LIABILITIES AND EQUITY Healthcare costs payable $2,145 Accrued expenses 929 Unearned premiums 382 Total current liabilities $3.456 Long-term debt $4,295 Total liabilities $7,751 Equity $2,118 Total liabilities and equity $9,869 a. Perform a DuPont analysis on BestCare. Assume that the sector average ratios are as follows: Total margin Total asset turnover 3.8% 2.1 Equity multiplier Return on equity 3.2 25.5% b. Calculate and interpret the following ratios for BestCare. Return on assets Current ratio DCOH (assume depreciation expense is $367) Average collection period Debt ratio Debt-to-equity ratio Times interest earned ratio Fixed-asset turnover ratio Sector Average 8.0% 1.3 41 days 7 days 69% 2.2 2.8 18.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a DuPont analysis is used to evaluate the return on equity ROE by breaking it down into three components profit margin asset turnover and equity multiplier 1 Profit Margin Net Income Total Revenue Bes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started