Answered step by step

Verified Expert Solution

Question

1 Approved Answer

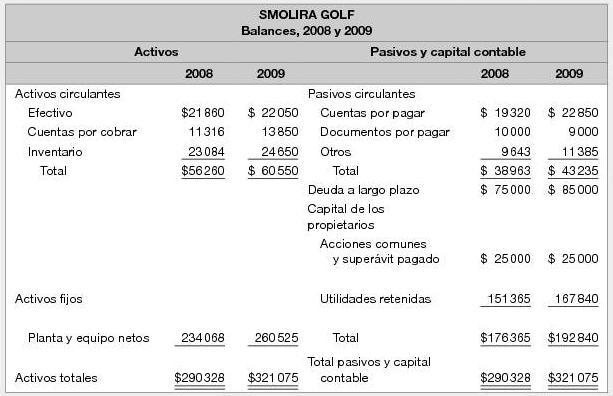

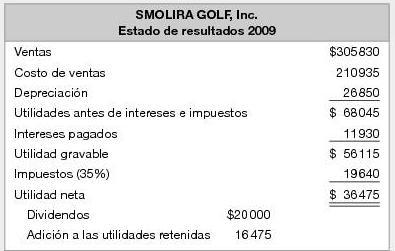

Consider the following financial statements of Smolira Golf, Inc .: Calculate the following financial ratios for Smolira Golf, Inc. for each year and analyze whether

Consider the following financial statements of Smolira Golf, Inc .:

Calculate the following financial ratios for Smolira Golf, Inc. for each year and analyze whether the company improved or worsened its financial situation (performance) and why.

• current liquidity

• debt ratio on total assets

• inventory turnover

• profit margin on sales

• return on capital (ROE)

• price-earnings or price-earnings ratio

Activos circulantes Efectivo Cuentas por cobrar Inventario Total Activos fijos Activos Planta y equipo netos Activos totales 2008 SMOLIRA GOLF Balances, 2008 y 2009 234068 2009 $21860 $ 22050 11316 13850 23084 24650 $56260 $ 60550 260 525 $290328 $321 075 Pasivos y capital contable 2008 Pasivos circulantes Cuentas por pagar Documentos por pagar Otros Total Deuda a largo plazo Capital de los propietarios Acciones comunes y supervit pagado Utilidades retenidas Total Total pasivos y capital contable $193201 10000 9643 2009 $25000 $ 22850 9000 11385 $38963 $ 43235 $ 75000. $85.000 $ 25000 151365 167840 $176365 $192840 $290328 $321 075 SMOLIRA GOLF, Inc. Estado de resultados 2009 Ventas Costo de ventas Depreciacin Utilidades antes de intereses e impuestos Intereses pagados Utilidad gravable Impuestos (35%) Utilidad neta Dividendos Adicin a las utilidades retenidas $20 000 16475 $305830 210935 26850 $ 68045 11930 $ 56115 19640 $36475

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Current Liquidity Current AssetsCurrent Liabilities 2008 5626038963 2009 6055043235 144 140 The cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

606d86319b9b9_713331.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started