Answered step by step

Verified Expert Solution

Question

1 Approved Answer

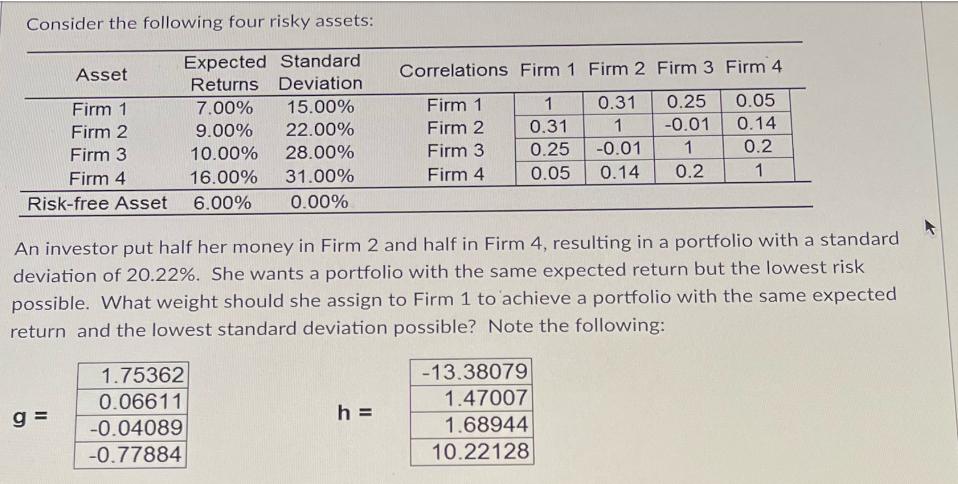

Expected Standard Asset Consider the following four risky assets: Correlations Firm 1 Firm 2 Firm 3 Firm 4 Returns Deviation Firm 1 7.00% 15.00%

Expected Standard Asset Consider the following four risky assets: Correlations Firm 1 Firm 2 Firm 3 Firm 4 Returns Deviation Firm 1 7.00% 15.00% Firm 1 1 0.31 0.25 0.05 Firm 2 9.00% 22.00% Firm 2 0.31 1 -0.01 0.14 Firm 3 10.00% 28.00% Firm 3 0.25 -0.01 1 0.2 Firm 4 16.00% Risk-free Asset 6.00% 31.00% 0.00% Firm 4 0.05 0.14 0.2 1 An investor put half her money in Firm 2 and half in Firm 4, resulting in a portfolio with a standard deviation of 20.22%. She wants a portfolio with the same expected return but the lowest risk possible. What weight should she assign to Firm 1 to achieve a portfolio with the same expected return and the lowest standard deviation possible? Note the following: 1.75362 0.06611 g= -0.04089 -0.77884 -13.38079 1.47007 h = 1.68944 10.22128 21.48% 61.63% O 68.32% O 8.10%

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To find the weight that should be assigned to Firm 1 in order to achieve a portfolio with the same e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started