Question

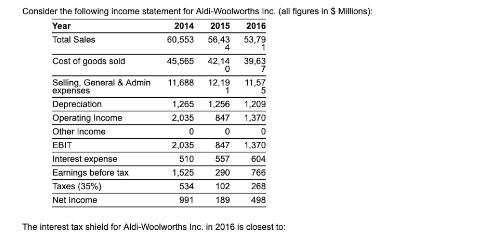

Consider the following income statement for Aldi-Woolworths Inc. (all figures in $ Millions): Year Total Sales Cost of goods sold Selling, General & Admin

Consider the following income statement for Aldi-Woolworths Inc. (all figures in $ Millions): Year Total Sales Cost of goods sold Selling, General & Admin expenses Depreciation 2014 2015 2016 60,553 56.43 53,79 1 39,63 7 45,565 42,14 11,688 12,19 11,57 1,265 1,256 1,209 Operating Income 2,035 847 1,370 Other Income 0 0 EBIT 2,035 847 1,370 Interest expense 510 557 604 Earnings before tax 1,525 290 766 Taxes (35%) 534 102 268 Net Income 991 189 498 The interest tax shield for Aldi-Woolworths Inc. in 2016 is closest to:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the interest tax shield for AldiWoolworths Inc in 2016 we need to find th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter

14th Global Edition

1292018208, 978-1292018201

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App