Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following independent situations: (i) The owner/manager of a privately-held company also owns 3 other companies. The entities could all be run as

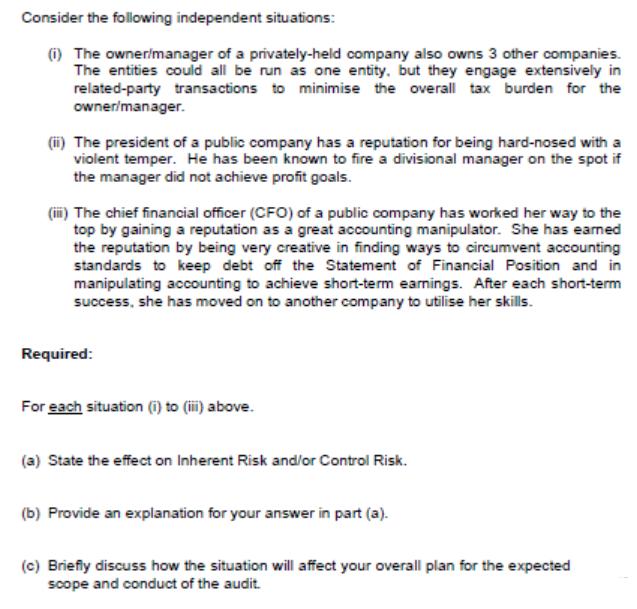

Consider the following independent situations: (i) The owner/manager of a privately-held company also owns 3 other companies. The entities could all be run as one entity. but they engage extensively in related-party transactions to minimise the overall tax burden for the ownerimanager. (i) The president of a public company has a reputation for being hard-nosed with a violent temper. He has been known to fire a divisional manager on the spot if the manager did not achieve profit goals. (ii) The chief financial officer (CFO) of a public company has worked her way to the top by gaining a reputation as a great accounting manipulator. She has eamed the reputation by being very creative in finding ways to circumvent accounting standards to keep debt off the Statement of Financial Position and in manipulating accounting to achieve short-term eanings. After each short-term success, she has moved on to another company to utilise her skills. Required: For each situation () to (i) above. (a) State the effect on Inherent Risk and/or Control Risk. (b) Provide an explanation for your answer in part (a). (c) Briefly discuss how the situation will affect your overall plan for the expected scope and conduct of the audit.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a b some Companies form subsidiaries sister concerns to make huge transactions in between them and m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started