Answered step by step

Verified Expert Solution

Question

1 Approved Answer

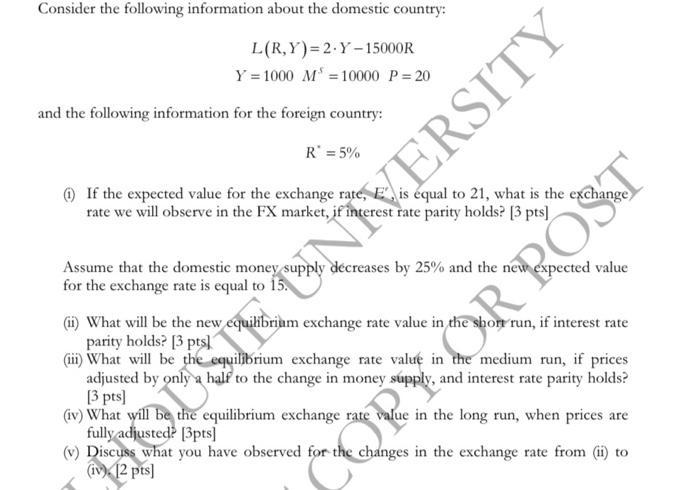

Consider the following information about the domestic country: ONIVERSITY RB L(R,Y)=2.Y-15000R Y = 1000 M 10000 P= 20 and the following information for the

Consider the following information about the domestic country: ONIVERSITY RB L(R,Y)=2.Y-15000R Y = 1000 M 10000 P= 20 and the following information for the foreign country: R = 5% O If the expected value for the exchange rate, E is qual to 21, what is the exchange rate we will observe in the FX market, if interest rate parity holds? [3 pts] ORY OR ROST C Assume that the domestic money supply decreases by 25% and the new expected value for the exchange rate is equal to 15. (1) What will be the new equilibrium exchange rate value in the short run, if interest rate parity holds? [3 pts (ii) What will be the equilibrium exchange rate valu in the medium run, if prices adjusted by only a half to the change in money supply, and interest rate parity holds? [3 pts] (iv) What will be the equilibrium exchange rate value in the long run, when prices are fully adjusted? [3pts] (v) Discuss what you have observed for the changes in the exchange rate from (i) to (i 12 pts]

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i Domestic Investment Ms 10000 Investment returns 1000011 11000 Foreign Investment Ms 1000021 Invest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started