Answered step by step

Verified Expert Solution

Question

1 Approved Answer

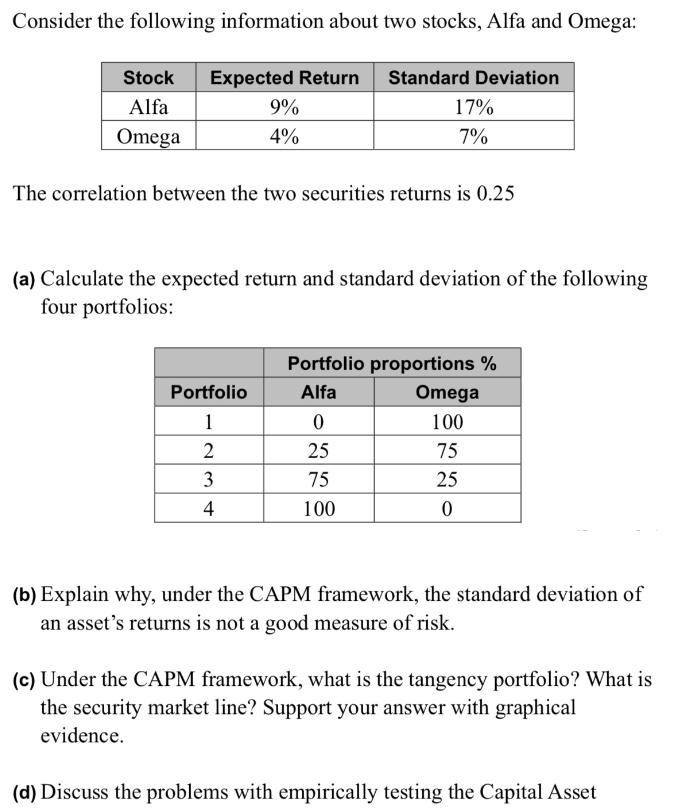

Consider the following information about two stocks, Alfa and Omega: Stock Expected Return Standard Deviation Alfa Omega The correlation between the two securities returns

Consider the following information about two stocks, Alfa and Omega: Stock Expected Return Standard Deviation Alfa Omega The correlation between the two securities returns is 0.25 Portfolio 1 9% 4% (a) Calculate the expected return and standard deviation of the following four portfolios: 234 17% 7% 4 Portfolio proportions % Alfa 0 25 75 100 Omega 100 75 25 0 (b) Explain why, under the CAPM framework, the standard deviation of an asset's returns is not a good measure of risk. (c) Under the CAPM framework, what is the tangency portfolio? What is the security market line? Support your answer with graphical evidence. (d) Discuss the problems with empirically testing the Capital Asset

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the expected return and standard deviation of the following four portfolios Portfolio Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started