Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following information and answer each of the questions below using arithmetic, algebra, and Excel functions as appropnate. Larz is considering an ARM

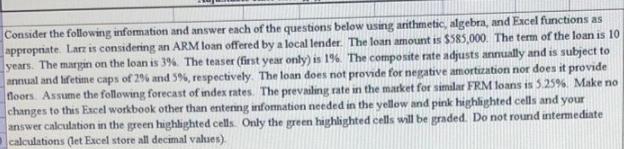

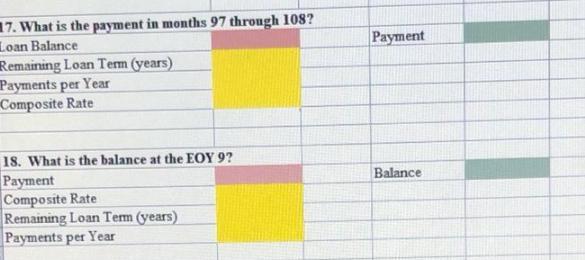

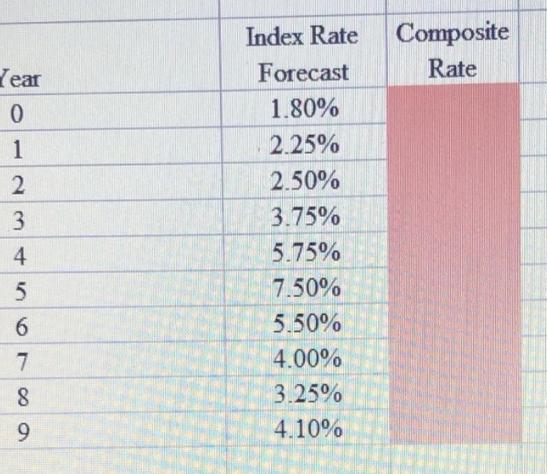

Consider the following information and answer each of the questions below using arithmetic, algebra, and Excel functions as appropnate. Larz is considering an ARM loan offered by a local lender. The loan amount is $585,000. The term of the loan is 10 years. The margin on the loan is 3%. The teaser (first year only) is 1%. The composite rate adjusts annually and is subject to annual and hfetime caps of 29% and 5%, respectively. The loan does not provide for negative amortization nor does it provide floors Assume the following forecast of index rates. The prevailing rate in the market for similar FRM loans is 5.25%. Make no changes to this Excel workbook other than entering infommation needed in the yellow and pink highighted cells and your answer calculation in the green highlighted cells. Only the green highlighted cells will be graded. Do not round intemediate calculations (let Excel store all decimal values) 17. What is the payment in months 97 through 108? Loan Balance Remaining Loan Term (years) Payments per Year Composite Rate ment 18. What is the balance at the EOY 9? Payment Composite Rate Remaining Loan Tem (years) Payments per Year Balance Index Rate Composite Tear Forecast Rate 1.80% 1 2.25% 2.50% 3.75% 5.75% 7.50% 6. 5.50% 7 4.00% 3.25% 9 4.10%

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

NF39 fe MZ NA NB NC ND NE NE Interest Rate Composite Rate 1 Loan Amount 2 Teaser rate Loan term 5850...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started