Answered step by step

Verified Expert Solution

Question

1 Approved Answer

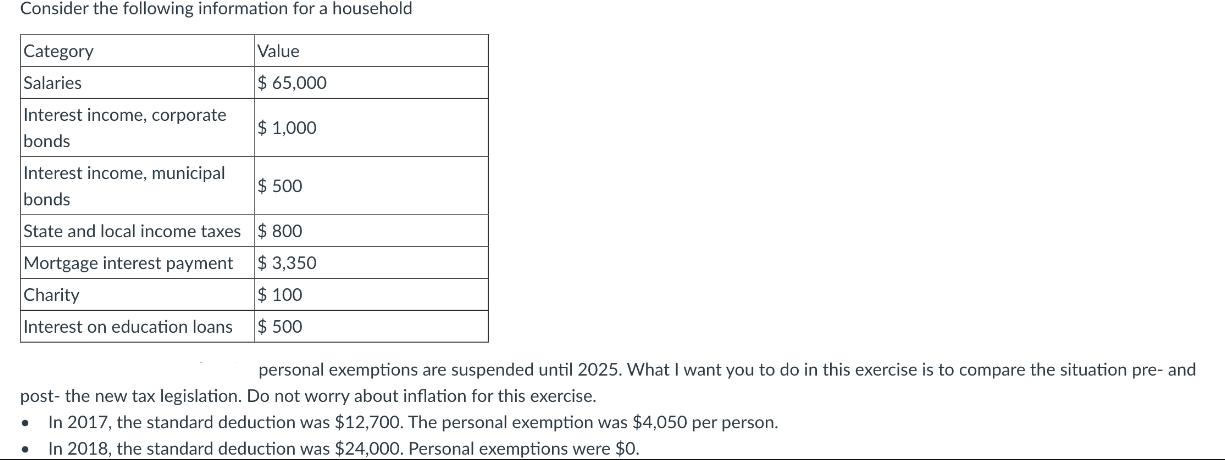

Consider the following information for a household Category Salaries $ 65,000 Interest income, corporate $ 1,000 bonds E Interest income, municipal $500 bonds State

Consider the following information for a household Category Salaries $ 65,000 Interest income, corporate $ 1,000 bonds E Interest income, municipal $500 bonds State and local income taxes $800 Mortgage interest payment $3,350 Charity $ 100 Interest on education loans Value $500 personal exemptions are suspended until 2025. What I want you to do in this exercise is to compare the situation pre- and post- the new tax legislation. Do not worry about inflation for this exercise. In 2017, the standard deduction was $12,700. The personal exemption was $4,050 per person. In 2018, the standard deduction was $24,000. Personal exemptions were $0. For both years, find the respective tax brackets for joint filings and compute the following: Adjusted gross income Taxable income Average tax rate Effective tax rate Marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compare the tax situation pre and post the new tax legislation we need to calculate the adjusted gross income taxable income average tax rate effective tax rate and marginal tax rate for both 2017 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started