Answered step by step

Verified Expert Solution

Question

1 Approved Answer

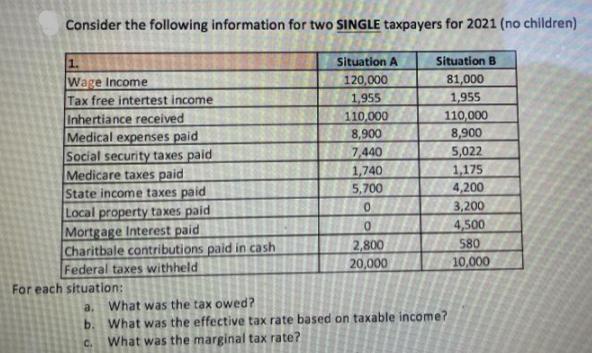

Consider the following information for two SINGLE taxpayers for 2021 (no children) 1. Wage Income Situation A Situation B 120,000 1,955 81,000 1,955 Tax

Consider the following information for two SINGLE taxpayers for 2021 (no children) 1. Wage Income Situation A Situation B 120,000 1,955 81,000 1,955 Tax free intertest income Inhertiance received Medical expenses paid Social security taxes paid Medicare taxes paid State income taxes paid Local property taxes paid Mortgage Interest paid Charitbale contributions paid in cash Federal taxes withheld 110,000 8,900 110,000 8,900 5,022 1,175 4,200 3,200 4,500 580 7,440 1,740 5,700 2,800 20,000 10,000 For each situation: What was the tax owed? b. What was the effective tax rate based on taxable income? What was the marginal tax rate? a. C.

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Quiz a For situation A the tax owed would be 0 This is because the total taxable income would be 120...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started