Question

Consider the following information on the options available on stock ABC. You intend to write one Jan maturity call option on company ABC's stock with

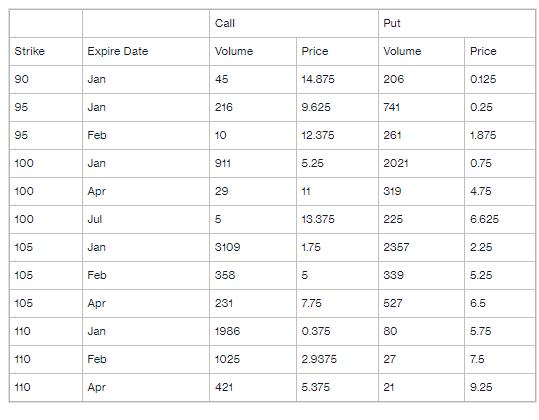

Consider the following information on the options available on stock ABC. You intend to write one Jan maturity call option on company ABC's stock with exercise price $105 and write one Jan maturity put option on the same underlying asset with strike price $100. The information of the options on the stock of company ABC is as follows:

Graph the payoff as well as the profit/loss of this portfolio at option expiration.

At what price range will you break even on your investment based on the payoff?

What will be the payoff and profit/loss on this portfolio if company ABC trades at $102 on the option maturity date?

Given the portfolio that you have constructed, what is most likely your view of the future for the price of ABC's stock?

Call Put Strike Expire Date Volume Price Volume Price 90 Jan 45 14.875 206 0.125 95 Jan 216 9.625 741 0.25 95 Feb 10 12.375 261 1.875 100 Jan 911 5.25 2021 0.75 100 Apr 29 11 319 4.75 100 Jul 5 13.375 225 6.625 105 Jan 3109 1.75 2357 2.25 105 Feb 358 5 339 5.25 105 Apr 231 7.75 527 6.5 110 Jan 1986 0.375 80 5.75 110 Feb 1025 2.9375 27 7.5 110 10 Apr 421 5.375 21 9.25

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To graph the payoff and profitloss of the portfolio we need to calculate the payoff of each option at expiration and then sum them up The payoff of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started