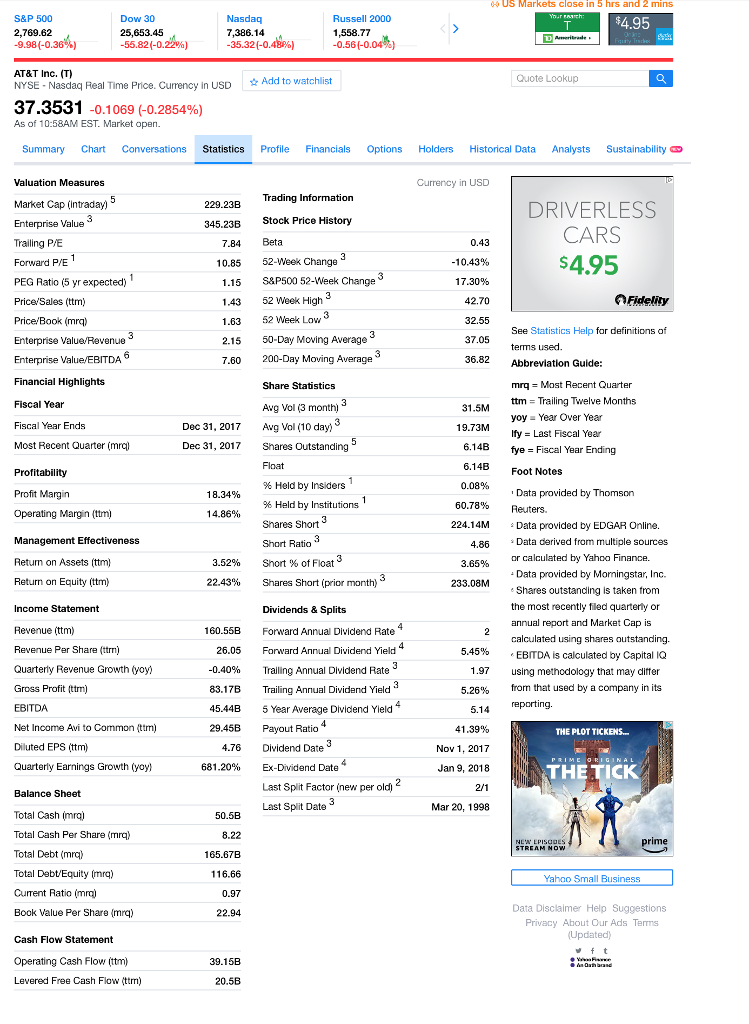

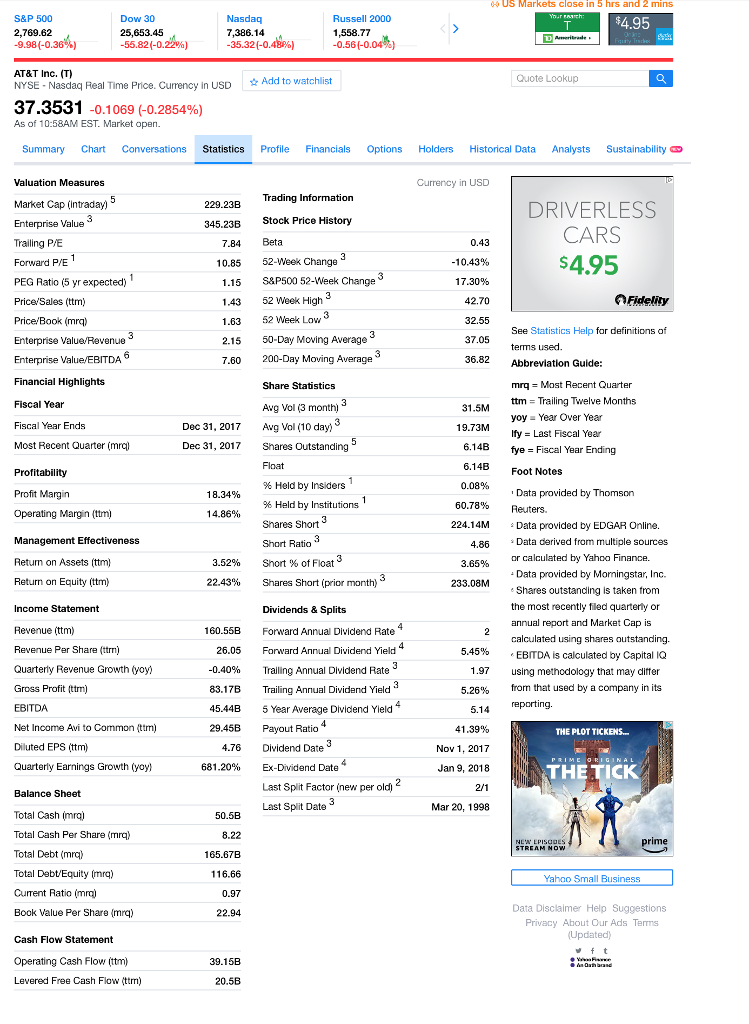

Consider the following information.

U.S. 30 year t-bond yield = 2.9%

Market Risk Premium = 6.25%

Tax Rate = 21%

Moodys Corporate Bond Rating for AT&T = Baa1 (assume 208 basis points)

Use Yahoo/Finance AT&T financial profile (see below) then answer the following questions.

1) Calculate the weighted cost of capital for AT&T

2) Calculate the MVA for AT&T

US Markets close in 5 hrs and 2 mins Dow 30 25,653.445 -55.82(-0.22%) S&P 500 Nasdaq 2,769.62 35.32(-0 0.56(-0 AT&T Inc. T) NYSE Nasdaq Real Time Price. Currency in USD Add to watchlist Quote Lookup 37.3531-0.1069 (-0.2854%) As of 10:58AM EST. Market open Summary Conversations Statstics Profile Financials Options Holders Historical Data Analysts Sustainability Valuation Measures Trading Information Market Cap (intraday) DRIVERLESS CARS s4.95 229.23E 345.23B Stock Price History 7.84 Beta 10.85 52-Week Change 10.43% PEG Ratio (5 yr expected) Price/Sales (ttm) Price Book (mrq) 1.15 S&P500 52-Week Change 1.43 52 Week High 1.63 2 Week Low 2.15 50-Day Moving Average 32.55 See Statistics Halp for definitions of Average 36.82 Abbrevlation Guide: Enterprise Value/EBITDA Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter mra) Share Statistics 31.5M yoy Year Over Year lfy = Last Fiscal Year fye = Fiscal Year Ending Foot Notes Dec 31, 2017 Avg Vol (10 day) Dec 31, 2017 Sares Outstanding 6.14B 6.14B 0.08% 60.78% % Held by Insiders % Held by Institutions Shares Short Short Ratio Short % of Float Shares Short (prior month) Dividends & Splits Data provided by Reuters. Profit Margin Operating Margin (tm) Management Effectiveness 18.34% 14.86% 224.14M Data provided by EDGAR Online. Data derived from multiple sources 4.86 3.65% 233.08NM 3.52% or calculated by Yahoo Finance. on Return on Equity (ttm) 22.43% Shares outstancing is taken from the most recently filed quarterly or annual report and Market Cap is calculated using shares outstanding. , EBITDA is calculated by Capital IQ using methodology that may differ from that used by a company in its Income Statement Revenue Per Share ttrn) Quarterly Revenue Growth yoy) Gross Profit (ttrm) EBITDA Net Income Avi to Common (ttm) Diluted EPS (tmi) Quarterly Earnings Growth (yoy) 160.55B Forward Annual Dividend Rate 26.05 Forward Annual Dividend Yield -0.40% Trailing Annual Dividend Rate 83.17B Trailing Annual Dividend Yield 45.44B5 Year Average Dividend Yield 5.45% 1.97 5.26% 29.45B Payout Ratio THE PLOT TICKENS 4.76 Dividend Date Nov 1, 2017 681.20% Ex-Dividend Date Last Split Factor inew per old Last Split Date Jan 9, 2018 THETICK Balance Sheet Total Cash imrq) Total Cash Per Share (mrq) Total Debt(mrq) Total Debt'Equity (mrq) Cument Ratio (mo) Book Value Per Share (mrq) Cash Flow Statement Operating Cash Flow (ttm) Levered Free Cash Flow (ttm) Mar 20, 1998 50.5B pr 165.67B Yahoo Small Business Data Disclaimer Help Suggestions Privacy About Our Ads Tens Updated) 20.5B US Markets close in 5 hrs and 2 mins Dow 30 25,653.445 -55.82(-0.22%) S&P 500 Nasdaq 2,769.62 35.32(-0 0.56(-0 AT&T Inc. T) NYSE Nasdaq Real Time Price. Currency in USD Add to watchlist Quote Lookup 37.3531-0.1069 (-0.2854%) As of 10:58AM EST. Market open Summary Conversations Statstics Profile Financials Options Holders Historical Data Analysts Sustainability Valuation Measures Trading Information Market Cap (intraday) DRIVERLESS CARS s4.95 229.23E 345.23B Stock Price History 7.84 Beta 10.85 52-Week Change 10.43% PEG Ratio (5 yr expected) Price/Sales (ttm) Price Book (mrq) 1.15 S&P500 52-Week Change 1.43 52 Week High 1.63 2 Week Low 2.15 50-Day Moving Average 32.55 See Statistics Halp for definitions of Average 36.82 Abbrevlation Guide: Enterprise Value/EBITDA Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter mra) Share Statistics 31.5M yoy Year Over Year lfy = Last Fiscal Year fye = Fiscal Year Ending Foot Notes Dec 31, 2017 Avg Vol (10 day) Dec 31, 2017 Sares Outstanding 6.14B 6.14B 0.08% 60.78% % Held by Insiders % Held by Institutions Shares Short Short Ratio Short % of Float Shares Short (prior month) Dividends & Splits Data provided by Reuters. Profit Margin Operating Margin (tm) Management Effectiveness 18.34% 14.86% 224.14M Data provided by EDGAR Online. Data derived from multiple sources 4.86 3.65% 233.08NM 3.52% or calculated by Yahoo Finance. on Return on Equity (ttm) 22.43% Shares outstancing is taken from the most recently filed quarterly or annual report and Market Cap is calculated using shares outstanding. , EBITDA is calculated by Capital IQ using methodology that may differ from that used by a company in its Income Statement Revenue Per Share ttrn) Quarterly Revenue Growth yoy) Gross Profit (ttrm) EBITDA Net Income Avi to Common (ttm) Diluted EPS (tmi) Quarterly Earnings Growth (yoy) 160.55B Forward Annual Dividend Rate 26.05 Forward Annual Dividend Yield -0.40% Trailing Annual Dividend Rate 83.17B Trailing Annual Dividend Yield 45.44B5 Year Average Dividend Yield 5.45% 1.97 5.26% 29.45B Payout Ratio THE PLOT TICKENS 4.76 Dividend Date Nov 1, 2017 681.20% Ex-Dividend Date Last Split Factor inew per old Last Split Date Jan 9, 2018 THETICK Balance Sheet Total Cash imrq) Total Cash Per Share (mrq) Total Debt(mrq) Total Debt'Equity (mrq) Cument Ratio (mo) Book Value Per Share (mrq) Cash Flow Statement Operating Cash Flow (ttm) Levered Free Cash Flow (ttm) Mar 20, 1998 50.5B pr 165.67B Yahoo Small Business Data Disclaimer Help Suggestions Privacy About Our Ads Tens Updated) 20.5B