Consider the following loan information. . Total acquisition price: $3,000,000. Property consists of twelve office suites, five on the first floor and seven on

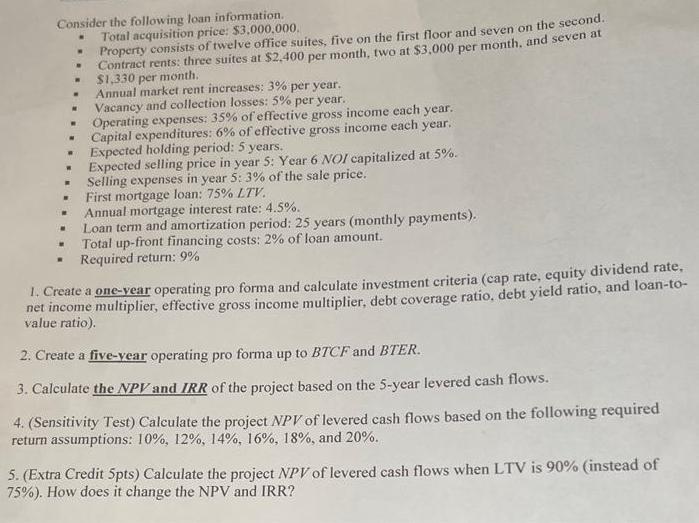

Consider the following loan information. . Total acquisition price: $3,000,000. Property consists of twelve office suites, five on the first floor and seven on the second. Contract rents: three suites at $2,400 per month, two at $3,000 per month, and seven at $1,330 per month. Annual market rent increases: 3% per year. W . .. . Vacancy and collection losses: 5% per year. .. Operating expenses: 35% of effective gross income each year. . Capital expenditures: 6% of effective gross income each year. . . W Expected holding period: 5 years. W Expected selling price in year 5: Year 6 NOI capitalized at 5%. Selling expenses in year 5: 3% of the sale price. First mortgage loan: 75% LTV. . . M Annual mortgage interest rate: 4.5%. Loan term and amortization period: 25 years (monthly payments). Total up-front financing costs: 2% of loan amount. Required return: 9% 1. Create a one-year operating pro forma and calculate investment criteria (cap rate, equity dividend rate, net income multiplier, effective gross income multiplier, debt coverage ratio, debt yield ratio, and loan-to- value ratio). 2. Create a five-year operating pro forma up to BTCF and BTER. 3. Calculate the NPV and IRR of the project based on the 5-year levered cash flows. 4. (Sensitivity Test) Calculate the project NPV of levered cash flows based on the following required return assumptions: 10%, 12%, 14%, 16%, 18%, and 20%. 5. (Extra Credit 5pts) Calculate the project NPV of levered cash flows when LTV is 90% (instead of 75%). How does it change the NPV and IRR?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 OneYear Operating Pro Forma and Investment Criteria Potential Gross Income PGI 2400 3 3000 2 1330 7 31710 12 380520 Vacancy and Collection Loss 5 38...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started