Answered step by step

Verified Expert Solution

Question

1 Approved Answer

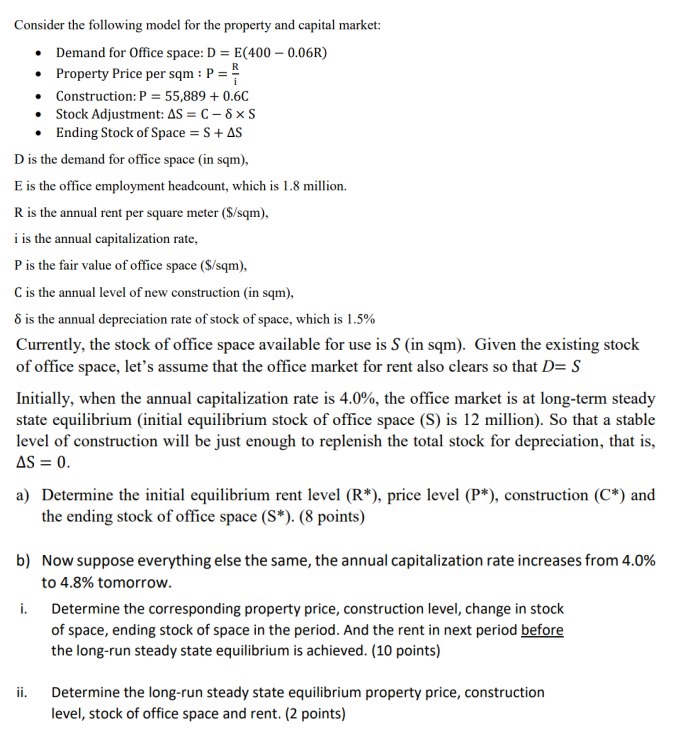

Consider the following model for the property and capital market: Demand for Office space: D = E(400 - 0.06R) Property Price per sqm :

Consider the following model for the property and capital market: Demand for Office space: D = E(400 - 0.06R) Property Price per sqm : P == Construction: P = 55,889 +0.6C Stock Adjustment: AS = C-8x S Ending Stock of Space = S + AS D is the demand for office space (in sqm), E is the office employment headcount, which is 1.8 million. R is the annual rent per square meter ($/sqm), i is the annual capitalization rate, P is the fair value of office space ($/sqm), C is the annual level of new construction (in sqm), 8 is the annual depreciation rate of stock of space, which is 1.5% Currently, the stock of office space available for use is S (in sqm). Given the existing stock of office space, let's assume that the office market for rent also clears so that D= S Initially, when the annual capitalization rate is 4.0%, the office market is at long-term steady state equilibrium (initial equilibrium stock of office space (S) is 12 million). So that a stable level of construction will be just enough to replenish the total stock for depreciation, that is, AS = 0. a) Determine the initial equilibrium rent level (R*), price level (P*), construction (C*) and the ending stock of office space (S*). (8 points) b) Now suppose everything else the same, the annual capitalization rate increases from 4.0% to 4.8% tomorrow. i. Determine the corresponding property price, construction level, change in stock of space, ending stock of space in the period. And the rent in next period before the long-run steady state equilibrium is achieved. (10 points) ii. Determine the long-run steady state equilibrium property price, construction level, stock of office space and rent. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the initial equilibrium rent level R price level P construction C and the ending stock of office space S we need to set the demand equal to the existing stock of office space D S and so...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started