Question

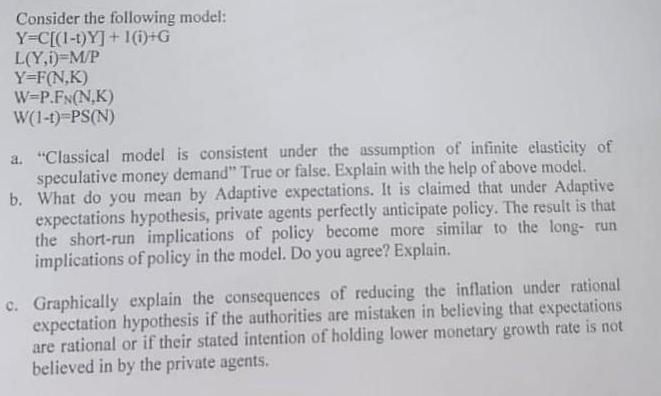

Consider the following model: Y=C[(1-t)Y]+1(i)+G L(Y,i)=M/P Y=F(N,K) W=P.FN(N,K) W(1-1)=PS(N) a. Classical model is consistent under the assumption of infinite elasticity of speculative money demand

Consider the following model: Y=C[(1-t)Y]+1(i)+G L(Y,i)=M/P Y=F(N,K) W=P.FN(N,K) W(1-1)=PS(N) a. "Classical model is consistent under the assumption of infinite elasticity of speculative money demand" True or false. Explain with the help of above model. b. What do you mean by Adaptive expectations. It is claimed that under Adaptive expectations hypothesis, private agents perfectly anticipate policy. The result is that the short-run implications of policy become more similar to the long- run implications of policy in the model. Do you agree? Explain. c. Graphically explain the consequences of reducing the inflation under rational expectation hypothesis if the authorities are mistaken in believing that expectations are rational or if their stated intention of holding lower monetary growth rate is not believed in by the private agents.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Regression Analysis And Other Multivariable Methods

Authors: David G. Kleinbaum, Lawrence L. Kupper, Azhar Nizam, Eli S. Rosenberg

5th Edition

1285051084, 978-1285963754, 128596375X, 978-1285051086

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App