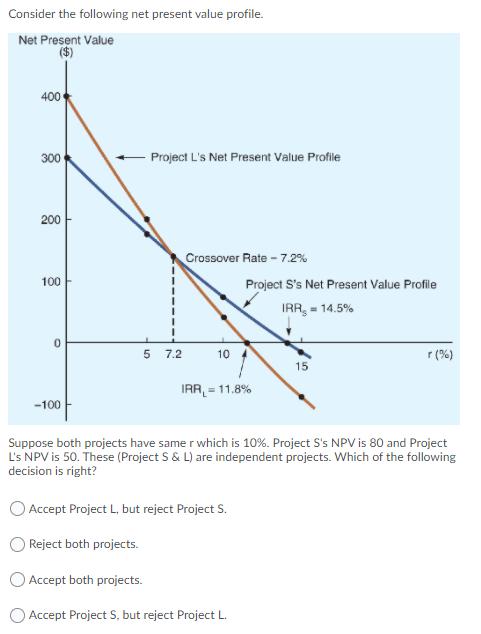

Consider the following net present value profile. Net Present Value 400 300 200 100 0 -100 1 Project L's Net Present Value Profile 5

Consider the following net present value profile. Net Present Value 400 300 200 100 0 -100 1 Project L's Net Present Value Profile 5 7.2 Crossover Rate - 7.2% 10 IRR = 11.8% Project S's Net Present Value Profile IRR = 14.5% Accept Project L, but reject Project S. Reject both projects. Accept both projects. Accept Project S, but reject Project L. 15 Suppose both projects have same r which is 10%. Project S's NPV is 80 and Project L's NPV is 50. These (Project S & L) are independent projects. Which of the following decision is right? r (%)

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The answer Accept both projects is vali...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started