Answered step by step

Verified Expert Solution

Question

1 Approved Answer

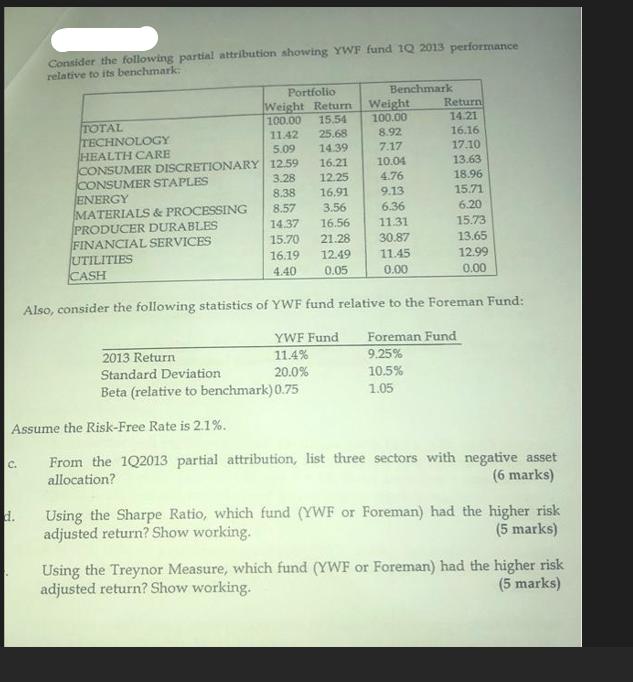

Consider the following partial attribution showing YWF fund 1Q 2013 performance relative to its benchmark Portfolio Benchmark Weight Return Weight Return TOTAL 100.00 15.54

Consider the following partial attribution showing YWF fund 1Q 2013 performance relative to its benchmark Portfolio Benchmark Weight Return Weight Return TOTAL 100.00 15.54 100.00 14.21 TECHNOLOGY 11.42 25.68 8.92 16.16 HEALTH CARE 5.09 14.39 7.17 17.10 CONSUMER DISCRETIONARY 12.59 16.21 10.04 13.63 CONSUMER STAPLES 3.28 12.25 4.76 18.96 ENERGY 8.38 16.91 9.13 15.71 MATERIALS & PROCESSING 8.57 3.56 6.36 6.20 PRODUCER DURABLES 14.37 16.56 11.31 15.73 FINANCIAL SERVICES 15.70 21.28 30.87 13.65 UTILITIES 16.19 12.49 11.45 12.99 4.40 0.05 0.00 0.00 CASH Also, consider the following statistics of YWF fund relative to the Foreman Fund: YWF Fund Foreman Fund 2013 Return 11.4% 9.25% Standard Deviation 20.0% 10.5% Beta (relative to benchmark) 0.75 1.05 C. d. Assume the Risk-Free Rate is 2.1%. From the 1Q2013 partial attribution, list three sectors with negative asset allocation? (6 marks) Using the Sharpe Ratio, which fund (YWF or Foreman) had the higher risk adjusted return? Show working. (5 marks) Using the Treynor Measure, which fund (YWF or Foreman) had the higher risk adjusted return? Show working. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Based on the partial attribution for YWF fund the three sectors with negative asset allocation are 1 Energy The weighted return for Energy is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started