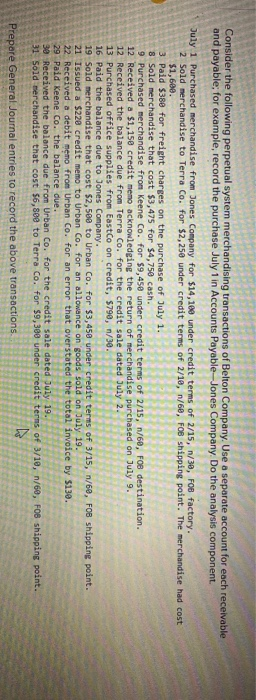

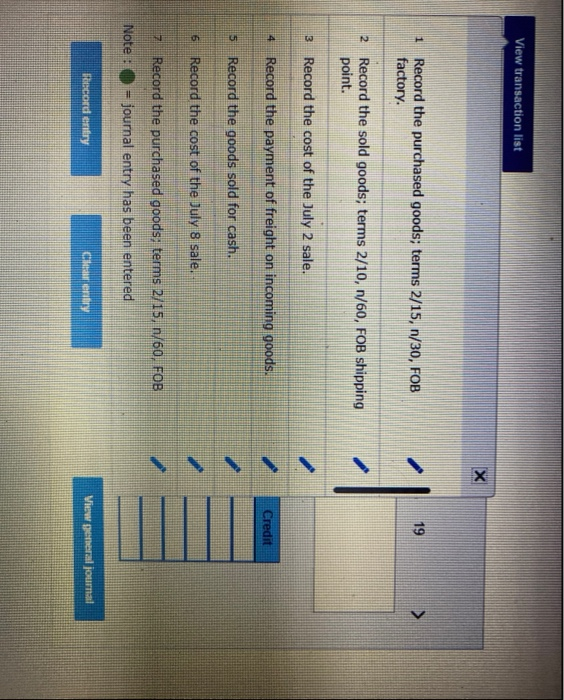

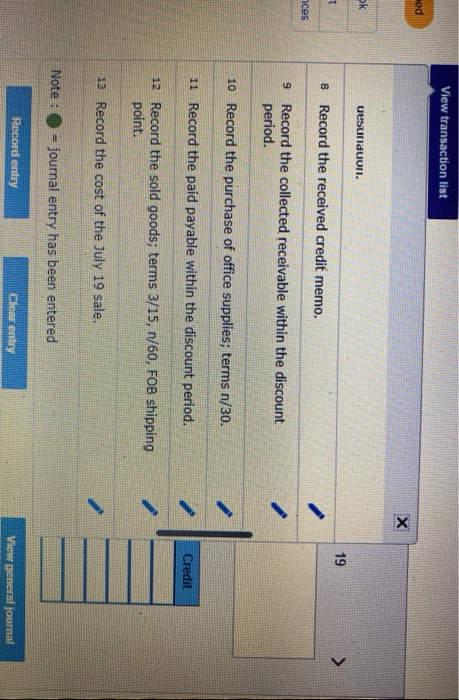

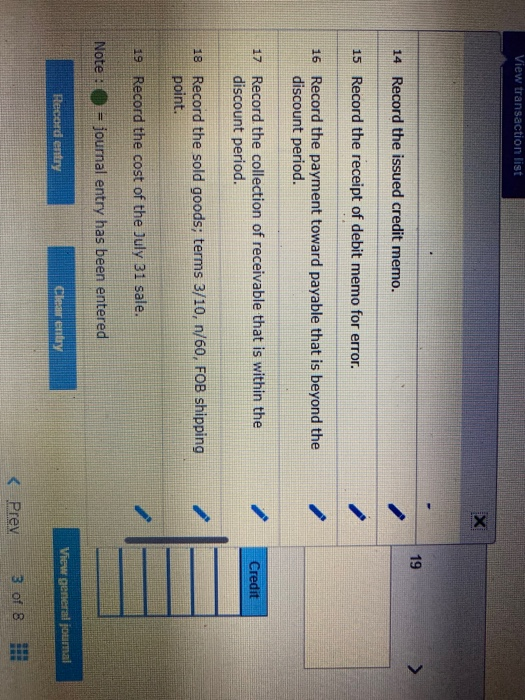

Consider the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable, for example, record the purchase July 1 in Accounts Payable-Jones Company. Do the analysis component. July 1 Purchased merchandise from Jones Company for $14, 100 under credit terms of 2/15, n/30, FOB factory. 2 Sold merchandise to Terra Co. for $2,250 under credit terms of 2/10, n/60, FOB shipping point. The merchandise had cost $1,600. 3 Paid $380 for freight charges on the purchase of July 1. 8 Sold merchandise that cost $3,475 for $4,750 cash. 9 Purchased merchandise from Keene Co. for $9,450 under credit terms of 2/15, n/60, FOB destination. 12 Received a $1,150 credit memo acknowledging the return of merchandise purchased on July 9. 12 Received the balance due from Terra Co. for the credit sale dated July 2. 13 Purchased office supplies from Eastco on credit, $790, n/30. 16 Paid the balance due to Jones Company. 19 Sold merchandise that cost $2,500 to Urban Co. for $3,450 under credit terms of 3/15, n/60, FOB shipping point. 21 Issued a $220 credit memo to Urban Co. for an allowance on goods sold on July 19. 22 Received a debit memo from Urban Co. for an error that overstated the total invoice by $130. 29 Paid Keene Co. the balance due. 30 Received the balance due from Urban Co. for the credit sale dated July 19. 31 Sold merchandise that cost $6,800 to Terra Co. for $9,300 under credit terms of 3/10, n/60, F08 Shipping point. Prepare General Journal entries to record the above transactions View transaction list X 1 19 Record the purchased goods; terms 2/15, n/30, FOB factory. 2 Record the sold goods; terms 2/10, 1/60, FOB shipping point. 3 Record the cost of the July 2 sale. 4 Record the payment of freight on incoming goods. Credit 5 Record the goods sold for cash. 6 Record the cost of the July 8 sale. Record the purchased goods; terms 2/15, 1/60. FOB Note = journal entry has been entered Record entry Ceny View general journal View transaction list med x ok UesuridLOTT. 19 t 8 Record the received credit memo. ces 9 Record the collected receivable within the discount period. 10 Record the purchase of office supplies; terms n/30. 2 11 Record the paid payable within the discount period. Credit 12 Record the sold goods; terms 3/15, n/60, FOB shipping point. 13 Record the cost of the July 19 sale. Note : journal entry has been entered Record entry Clear entry View general journal View transaction list x 19 14 Record the issued credit memo. 15 Record the receipt of debit memo for error. 16 Record the payment toward payable that is beyond the discount period. 17 Record the collection of receivable that is within the discount period. Credit 18 Record the sold goods; terms 3/10, n/60, FOB shipping point. 19 Record the cost of the July 31 sale. Note: journal entry has been entered Record entry Clear entry View general journal