Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following plain vanilla interest rate swap: Can you please explain the work? I am trying to understand how to do it. Consider the

Consider the following plain vanilla interest rate swap:

Can you please explain the work? I am trying to understand how to do it.

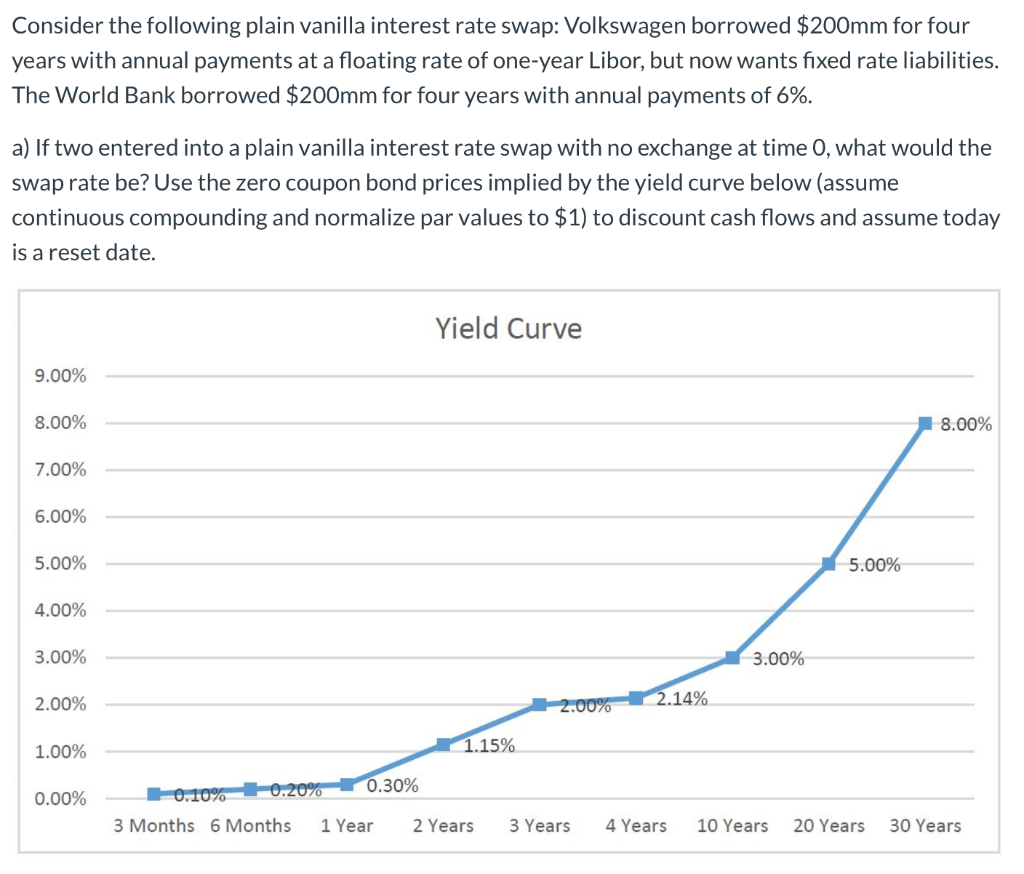

Consider the following plain vanilla interest rate swap: Volkswagen borrowed $200mm for four years with annual payments at a floating rate of one-year Libor, but now wants fixed rate liabilities. The World Bank borrowed $200mm for four years with annual payments of 6%. a) If two entered into a plain vanilla interest rate swap with no exchange at time 0, what would the swap rate be? Use the zero coupon bond prices implied by the yield curve below (assume continuous compounding and normalize par values to $1) to discount cash flows and assume today is a reset date. Yield Curve 9.00% 8.00% 8.00% 7.00% 6.00% 5.00% 5.00% 4.00% 3.00% 3.00% 2.00% 2.14% 70 1.00% 1.15% 0.00% 0.10% 0.20% 0.30% 3 Months 6 Months 1 Year 2 Years 3 Years 4 Years 10 Years 20 Years 30 Years Consider the following plain vanilla interest rate swap: Volkswagen borrowed $200mm for four years with annual payments at a floating rate of one-year Libor, but now wants fixed rate liabilities. The World Bank borrowed $200mm for four years with annual payments of 6%. a) If two entered into a plain vanilla interest rate swap with no exchange at time 0, what would the swap rate be? Use the zero coupon bond prices implied by the yield curve below (assume continuous compounding and normalize par values to $1) to discount cash flows and assume today is a reset date. Yield Curve 9.00% 8.00% 8.00% 7.00% 6.00% 5.00% 5.00% 4.00% 3.00% 3.00% 2.00% 2.14% 70 1.00% 1.15% 0.00% 0.10% 0.20% 0.30% 3 Months 6 Months 1 Year 2 Years 3 Years 4 Years 10 Years 20 Years 30 YearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started