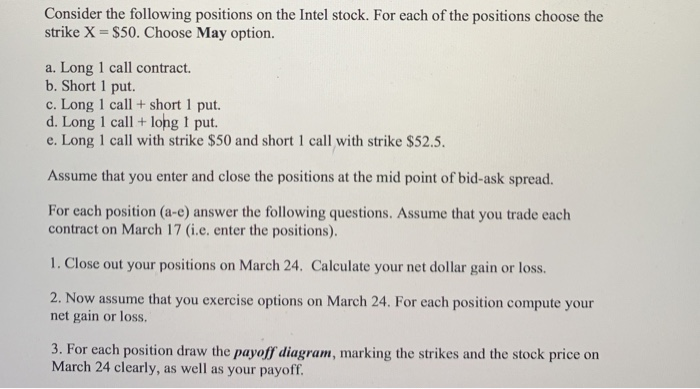

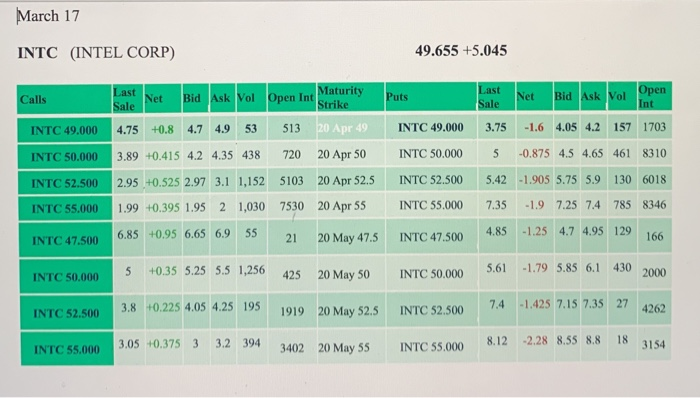

Consider the following positions on the Intel stock. For each of the positions choose the strike X = $50. Choose May option. a. Long 1 call contract. b. Short 1 put. c. Long 1 call + short 1 put. d. Long 1 call + long I put. e. Long 1 call with strike $50 and short I call with strike $52.5. Assume that you enter and close the positions at the mid point of bid-ask spread. For each position (a-e) answer the following questions. Assume that you trade each contract on March 17 (i.e. enter the positions). 1. Close out your positions on March 24. Calculate your net dollar gain or loss. 2. Now assume that you exercise options on March 24. For each position compute your net gain or loss. 3. For each position draw the payoff diagram, marking the strikes and the stock price on March 24 clearly, as well as your payoff. March 17 INTC (INTEL CORP) 49.655 +5.045 Sale Calls INTC 49.000 INTC 50.000 bar: Net Bid Ask Vol Open Ine Salernity 4.75 +0.8 4.7 4.9 53 51320 Apr 49 3.89 +0.415 4.2 4.35 438 720 20 Apr 50 2.95 +0.525 2.97 3.1 1,152 5103 20 Apr 52.5 1.99 +0.395 1.95 2 1,030 7530 20 Apr 55 Puts INTC 49.000 INTC 50.000 INTC 52.500 INTC 55.000 Net Bid Ask Yol Open 3.75 -1.6 4.05 4.2 157 1703 5 -0.875 4.5 4.65 461 8310 5.42 -1.905 5.75 5.9 130 6018 7.35 1.9 7.25 74 785 8346 4.85 -1.25 4.7 4.95 129 INTC 52.500 INTC 55.000 INTC 47.500 6.85 +0,95 6.65 6.9 55 21 20 May 47.5 INTC 47.500 INTC 50.000 5 +0.35 5.25 5.5 1,256 425 20 May 50 INTC 50.000 5.61 -1.79 5.85 6.1 430 2000 INTC 52.500 3.8 +0.225 4.05 4.25 195 1919 20 May 52.5 INTC 52.500 7.4 -1.425 7.15 7.35 27 4262 INTC 55.000 3.05 0.375 3 3.2 394 3402 340220 May 55 20 May INTC 55.000 8.12 -2.28 8.55 8.8 18 3154 March 24 INTC (INTEL CORP) 52.4 +2.82 Calls INTC 49.000 INTC 50.000 INTC 52.500 Sale Net Bid Ask Vol Open Int Maturity Puts Open Last Sale Net Strike Bid Int 5.8 +2.6 4.9 7 35 1160 20 Apr 49 INTC 49.000 2.05 .17 1.79 2.25 2,12 2003 4.42 +1.725 4.3 5.1 648 277920 Apr 50 INTC 50.000 2.32 -1.932.06 2.76 390 8612 3.3 +1.64 2.874 817 6500 20 Apr 52.5 INTC 52.500 3.46 2.215 3 3.9 187 5771 INTC 55.000 2.3 +1.38 1.67 2,38 2,085 9491 20 Apr 55 INTC 55.000 4.55 -2.85 4.2 5.05 1,048695 INTC 47.500 INTC 50.000 INTC 52.500 INTC 55.000 7.5 +2.5 6.8 8.6 17 274 5.8 +2.175 5.15 6.1 97 2206 4.45 +1.985 3.7 5 790 3016 3.15 +1.59 2.5 3.35 1,231 6528 20 May 47.5 INTC 47.500 20 May 50 INTC 50.000 20 May 52.5 INTC 52.500 20 May 55 INTC 55.000 2.82 3.47 4.76 5.65 -1.43 1.7 3.2 78 428 -1.905 2.95 4.15 590 2766 -2.015 3.4 5.3 146 4247 -2.75 4.45 6.2 738 2847