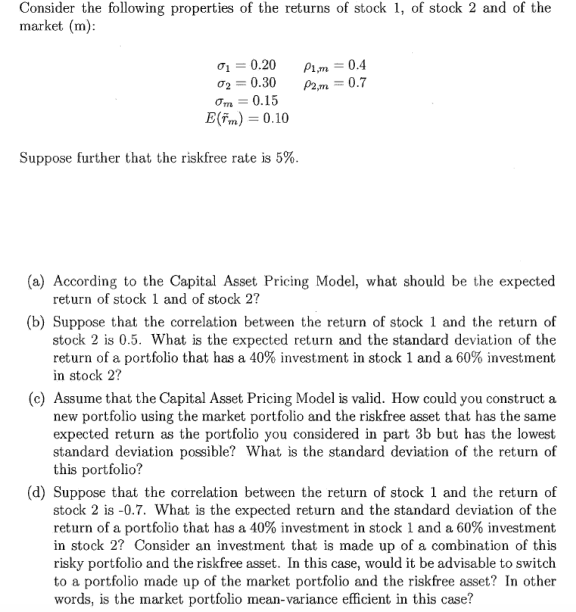

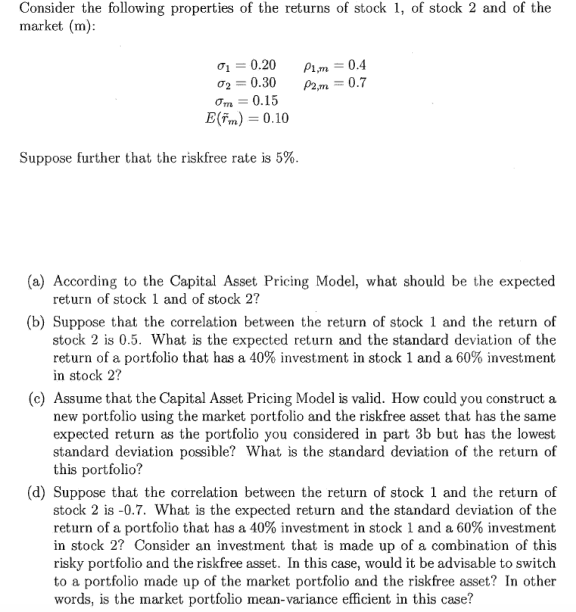

Consider the following properties of the returns of stock 1, of stock 2 and of the market (m) 0.4 0.7 Onl 0.15 E(%) 0.10 Suppose further that the riskfree rate is 5% (a) According to the Capital Asset Pricing Model, what should be the expected return of stock 1 and of stock 2? (b) Suppose that the correlation between the return of stock 1 and the return of stock 2 is 0.5. What is the expected return and the standard deviation of the return of a portfolio that has a 40% investment in stock 1 and a 60% investment in stock 2? (c) Assume that the Capital Asset Pricing Model is valid. How could you construct a new portfolio using the market portfolio and the riskfree asset that has the same expected return as the portfolio you considered in part 3b but has the lowest standard deviation this portfolio? possible? What is the standard deviation of the return of (d) Suppose that the correlation between the return of stock 1 and the return of stock 2 is -0.7. What is the expected return and the standard deviation of the return of a portfolio that has a 40% investment in stock 1 and a 60% investment in stock 2? Consider an investment that is made up of a combination of this risky portfolio and the riskfree asset. In this case, would it be advisable to switch to a portfolio made up of the market portfolio and the riskfree asset? In other words, is the market portfolio mean-variance efficient in this case? Consider the following properties of the returns of stock 1, of stock 2 and of the market (m) 0.4 0.7 Onl 0.15 E(%) 0.10 Suppose further that the riskfree rate is 5% (a) According to the Capital Asset Pricing Model, what should be the expected return of stock 1 and of stock 2? (b) Suppose that the correlation between the return of stock 1 and the return of stock 2 is 0.5. What is the expected return and the standard deviation of the return of a portfolio that has a 40% investment in stock 1 and a 60% investment in stock 2? (c) Assume that the Capital Asset Pricing Model is valid. How could you construct a new portfolio using the market portfolio and the riskfree asset that has the same expected return as the portfolio you considered in part 3b but has the lowest standard deviation this portfolio? possible? What is the standard deviation of the return of (d) Suppose that the correlation between the return of stock 1 and the return of stock 2 is -0.7. What is the expected return and the standard deviation of the return of a portfolio that has a 40% investment in stock 1 and a 60% investment in stock 2? Consider an investment that is made up of a combination of this risky portfolio and the riskfree asset. In this case, would it be advisable to switch to a portfolio made up of the market portfolio and the riskfree asset? In other words, is the market portfolio mean-variance efficient in this case