Answered step by step

Verified Expert Solution

Question

1 Approved Answer

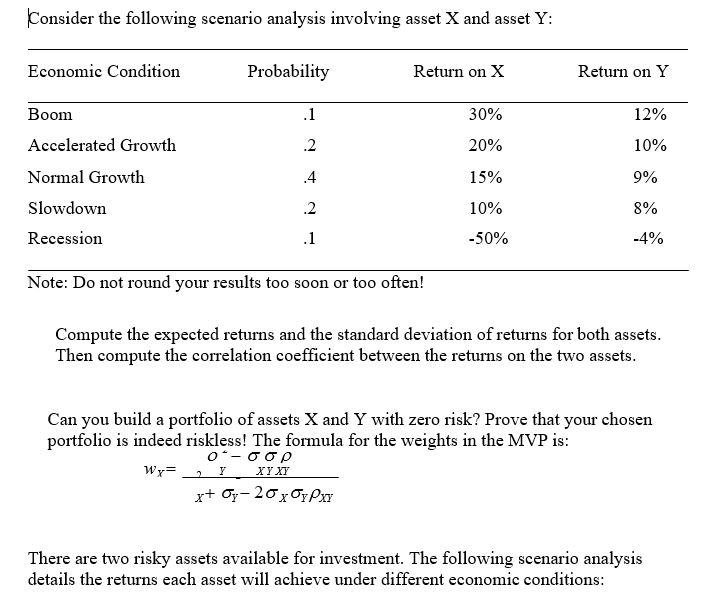

Consider the following scenario analysis involving asset X and asset Y: Economic Condition Probability Return on X Return on Y Boom .1 30% 12%

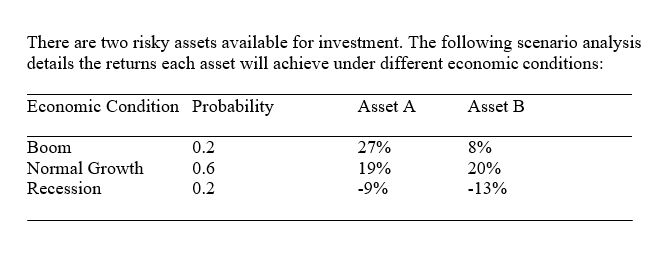

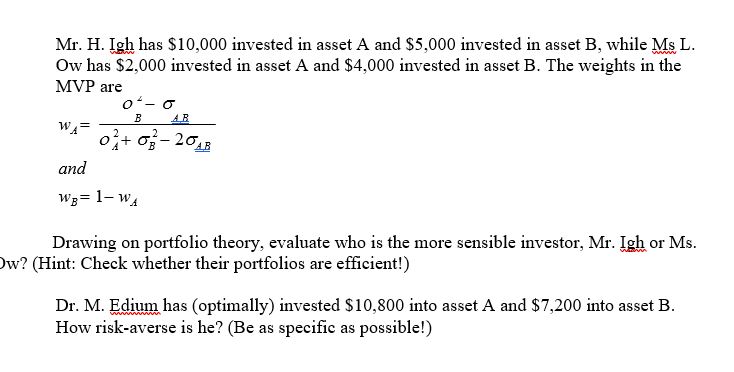

Consider the following scenario analysis involving asset X and asset Y: Economic Condition Probability Return on X Return on Y Boom .1 30% 12% Accelerated Growth .2 20% 10% Normal Growth .4 15% 9% Slowdown Recession 21 .2 10% 8% -50% -4% Note: Do not round your results too soon or too often! Compute the expected returns and the standard deviation of returns for both assets. Then compute the correlation coefficient between the returns on the two assets. Can you build a portfolio of assets X and Y with zero risk? Prove that your chosen portfolio is indeed riskless! The formula for the weights in the MVP is: -- WxY XY XY x+x-20x0PXY There are two risky assets available for investment. The following scenario analysis details the returns each asset will achieve under different economic conditions: There are two risky assets available for investment. The following scenario analysis details the returns each asset will achieve under different economic conditions: Economic Condition Probability Asset A Asset B Boom 0.2 27% 8% Normal Growth 0.6 19% 20% Recession 0.2 -9% -13% Mr. H. Igh has $10,000 invested in asset A and $5,000 invested in asset B, while Ms L. Ow has $2,000 invested in asset A and $4,000 invested in asset B. The weights in the MVP are WA and B AB 0+ -20AB WB= 1-WA Drawing on portfolio theory, evaluate who is the more sensible investor, Mr. Igh or Ms. Ow? (Hint: Check whether their portfolios are efficient!) Dr. M. Edium has (optimally) invested $10,800 into asset A and $7,200 into asset B. How risk-averse is he? (Be as specific as possible!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started