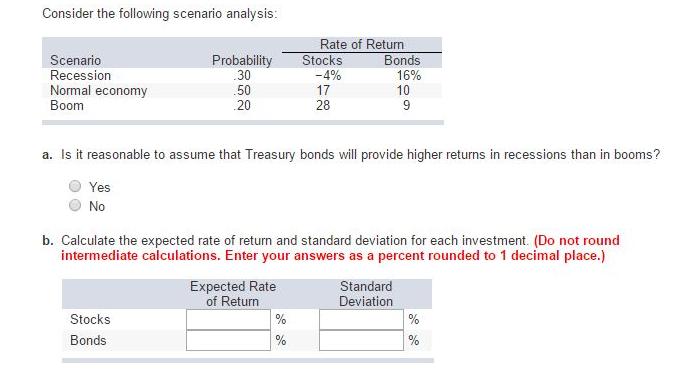

Consider the following scenario analysis: Scenario. Recession Normal economy Boom Probability .30 .50 .20 Stocks Bonds Rate of Return Expected Rate of Return Stocks

Consider the following scenario analysis: Scenario. Recession Normal economy Boom Probability .30 .50 .20 Stocks Bonds Rate of Return Expected Rate of Return Stocks -4% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? Yes No % % 17 28 b. Calculate the expected rate of return and standard deviation for each investment. (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place.) Bonds 16% 10 9 Standard Deviation % %

Step by Step Solution

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Yes it is reasonable to assume that Treasury bonds will provide higher returns in recessi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started