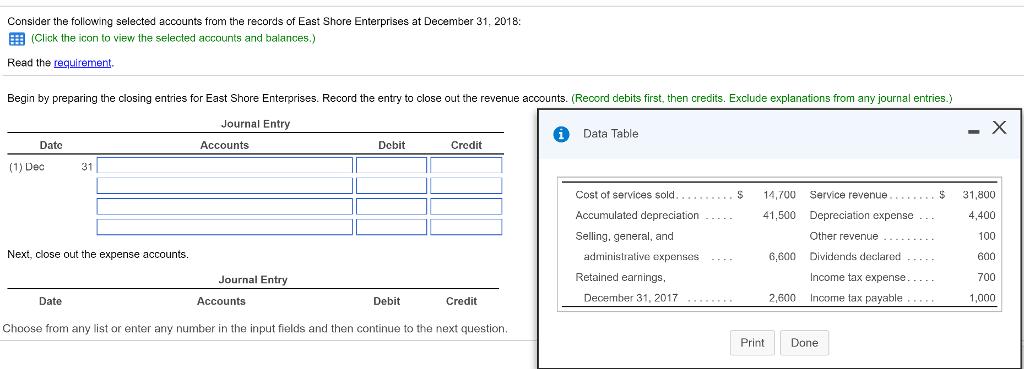

Consider the following selected accounts from the records of East Shore Enterprises at December 31, 2018: E (Click the icon to view the selected

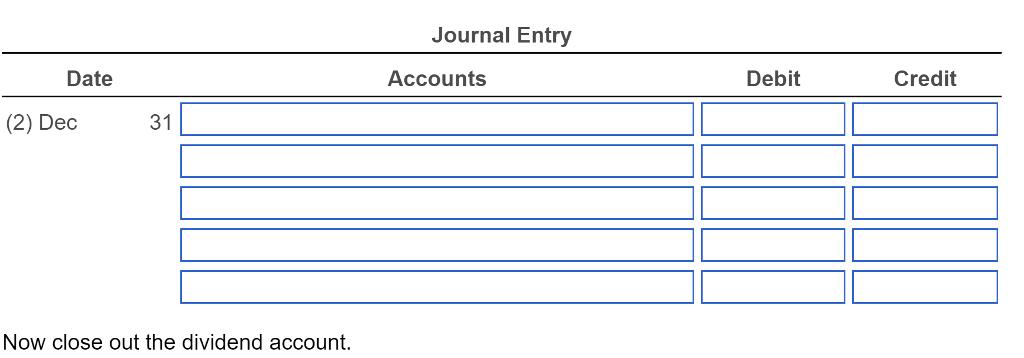

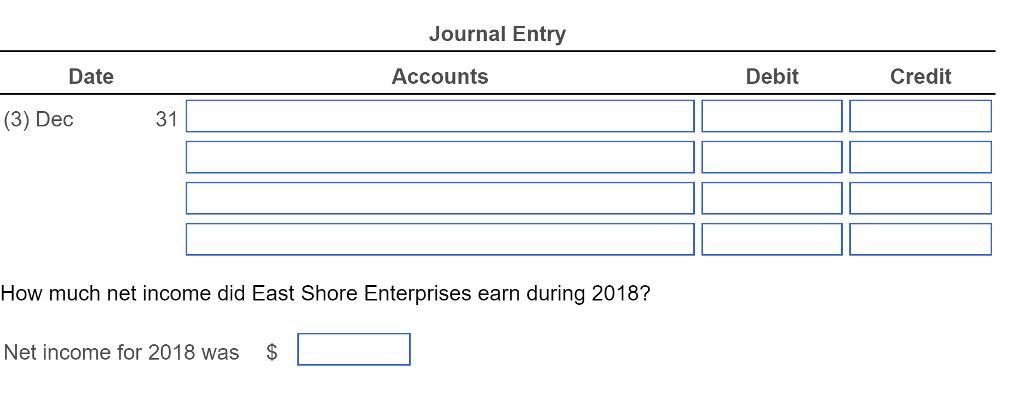

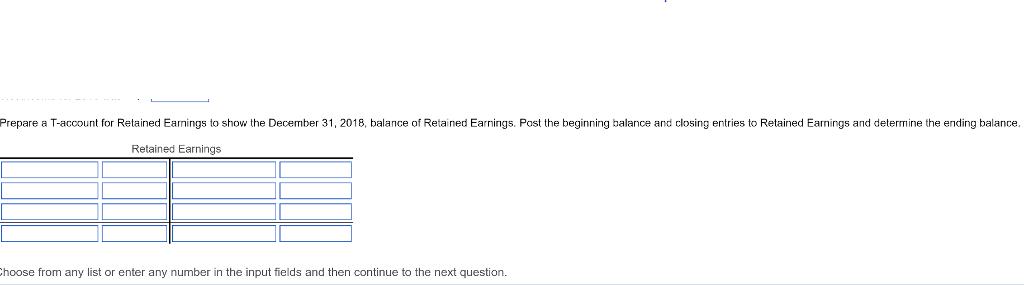

Consider the following selected accounts from the records of East Shore Enterprises at December 31, 2018: E (Click the icon to view the selected accounts and balances.) Read the requirement. Begin by preparing the closing entries for East Shore Enterprises. Record the entry to close out the revenue accounts. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry - X i Data Table Date Accounts Debit Credit (1) Dec 31 Cost of services sold..........S 14,700 Service revenue... $ 31,800 Accumulated depreciation 41,500 Depreciation expense ... 4,400 Selling, general, and Other revenue 100 Next, close out the expense accounts. administrative expenses.... 6,600 Dividends declared d.. 600 Journal Entry Retained earnings, Income tax expense..... 700 December 31, 2017........ 2,600 Income tax payable..... 1,000 Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. Print Done Journal Entry Date Accounts Debit Credit (2) Dec 31 Now close out the dividend account. Journal Entry Date Accounts Debit Credit (2) Dec 31 Now close out the dividend account. Journal Entry Date Accounts Debit Credit (3) Dec 31 How much net income did East Shore Enterprises earn during 2018? Net income for 2018 was 2$ Prepare a T-account for Retained Earnings to show the December 31, 2018, balance of Retained Earnings. Post the beginning balance and closing entries to Retained Earnings and determine the ending balance. Retained Earnings Choose from any list or enter any number in the input fields and then continue to the next question.

Step by Step Solution

3.30 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

All working forms part of the answer Closing Entries Date Accounts title Debit Cr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

636169fd16bdb_235735.pdf

180 KBs PDF File

636169fd16bdb_235735.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started