Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following share repurchase proposal: Blaine will use $209 million of cash from its balance sheet and $50 million in new debt bearing at

- Consider the following share repurchase proposal: Blaine will use $209 million of cash from its balance sheet and $50 million in new debt bearing at an interest rate of 6.75% to repurchase 14.0 million shares at a price of $18.50 per share. How would such a buyback change Blaine's:

- Debt ratio?

- Interest coverage ratio?

- Earnings per share?

- As a member of Blaine's controlling family, would you be in favor of the proposed recapitalization in #3 above? Would you be in favor of it as a non-family shareholder? Explain why yes or no

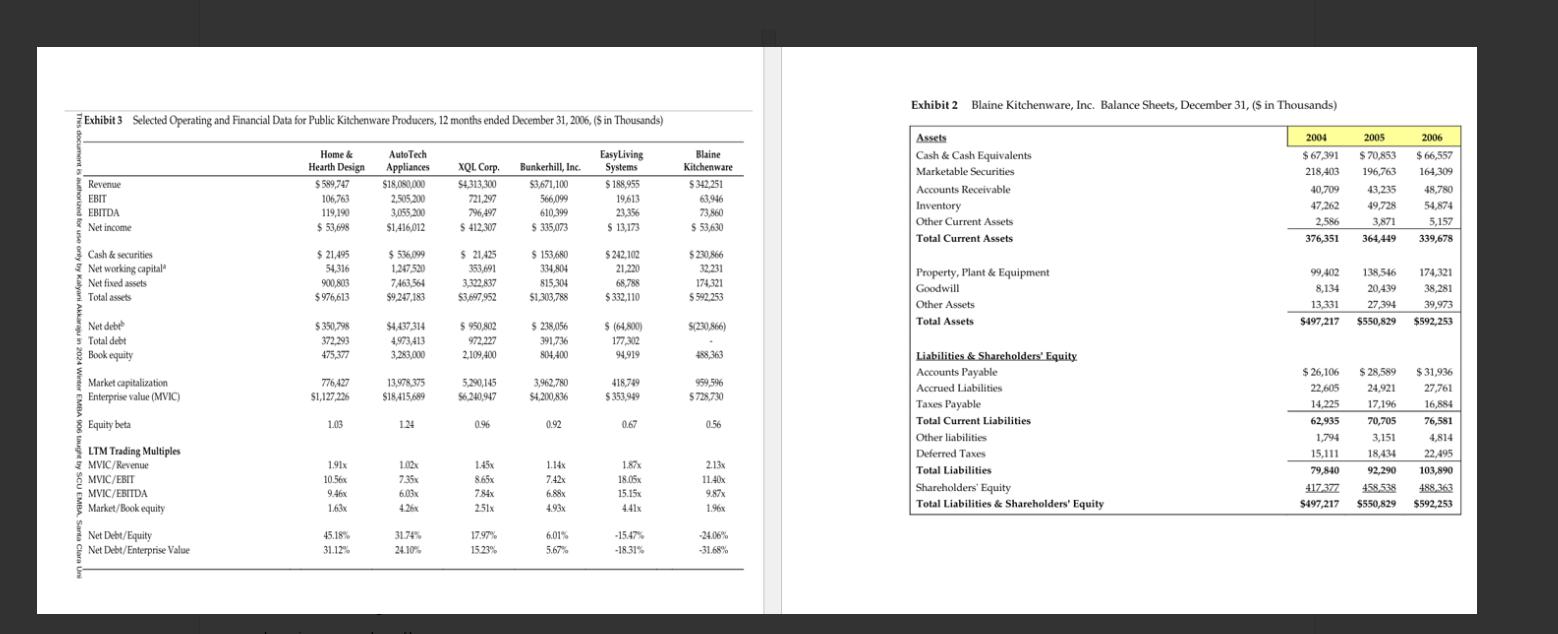

Exhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, ($ in Thousands) Revenue EBIT Home & Hearth Design $589,747 AutoTech Appliances EasyLiving 106,763 $18,080,000 2,505,200 XQL Corp. $4,313,300 721,297 566,099 EBITDA Net income 119,190 3,055,200 796,497 610,399 Bunkerhill, Inc. Systems $3,671,100 $188,955 19,613 23,356 $ 53,698 $1,416,012 $ 412,307 $335,073 $ 13,173 Cash & securities $ 21,495 $536,099 $ 21,425 $153,680 $242,102 Net working capital 54,316 1,247,520 Net fixed assets 900,803 7,463,564 Total assets Net debe Total debt Book equity $976,613 $9,247,183 353,691 3,322,837 $3,697,952 334,804 815,304 $1,303,788 21,220 68,788 $332,110 $350,798 372,293 $4,437,314 $ 950,802 $ 238,056 $ (64,800) 4,973,413 972,227 391,736 475,377 3,283,000 2,109,400 804,400 177,302 94,919 Market capitalization 776,427 13,978,375 5,290,145 3,962,780 Enterprise value (MVIC) $1,127,226 $18,415,689 $6,240,947 $4,200,836 418,749 $353,949 Equity beta 1.03 1.24 0.96 0.92 0.67 LTM Trading Multiples MVIC/Revenue 1.91x 1.02x 1.45x 1.14x 1.87x MVIC/EBIT 10.56x 7.35x 8.65x 7.42x 18.05x MVIC/EBITDA 9.46x 6.03x 7.84x 6.88x 15.15x Market/Book equity 1.63x 4.26x 251x 4.93x 4.41x Net Debt/Equity 45.18% 31.74% 17.97% 6.01% -15.47% Net Debt/Enterprise Value 31.12% 24.10% 15.23% 5.67% -18.31% Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, ($ in Thousands) Assets Cash & Cash Equivalents Marketable Securities Accounts Receivable Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Goodwill Other Assets Total Assets Liabilities & Shareholders' Equity Accounts Payable Accrued Liabilities Taxes Payable Total Current Liabilities Other liabilities Deferred Taxes Total Liabilities Shareholders' Equity Total Liabilities & Shareholders' Equity 2004 2005 2006 $ 67,391 $70,853 $66,557 218,403 196,763 164,309 40,709 43,235 48,780 47,262 49,728 54,874 2,586 3,871 5,157 376,351 364,449 339,678 99,402 138,546 174,321 8,134 13,331 38,281 39,973 $497,217 $550,829 $592,253 20,439 27,394 $26,106 $28,589 $31,936 22,605 24,921 27,761 14,225 17,196 16,884 62,935 70,705 76,581 1,794 3,151 4,814 15,111 18,434 22,495 79,840 92,290 103,890 417.377 458.538 488,363 $497,217 $550,829 $592,253

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started