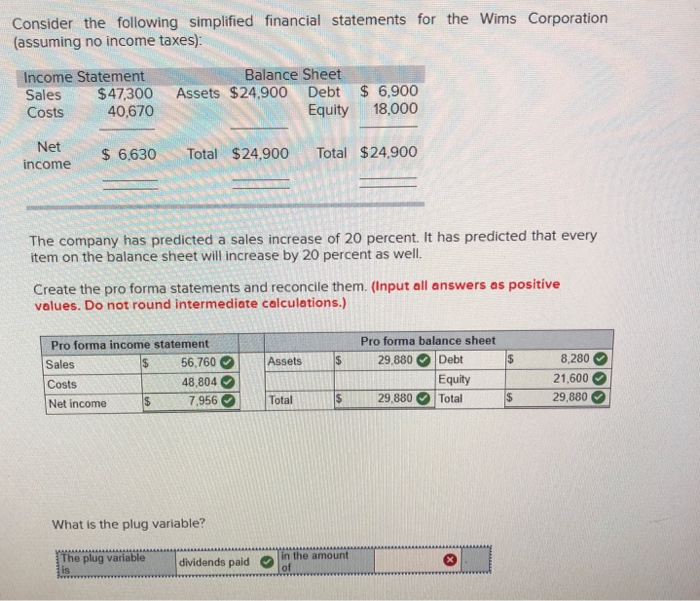

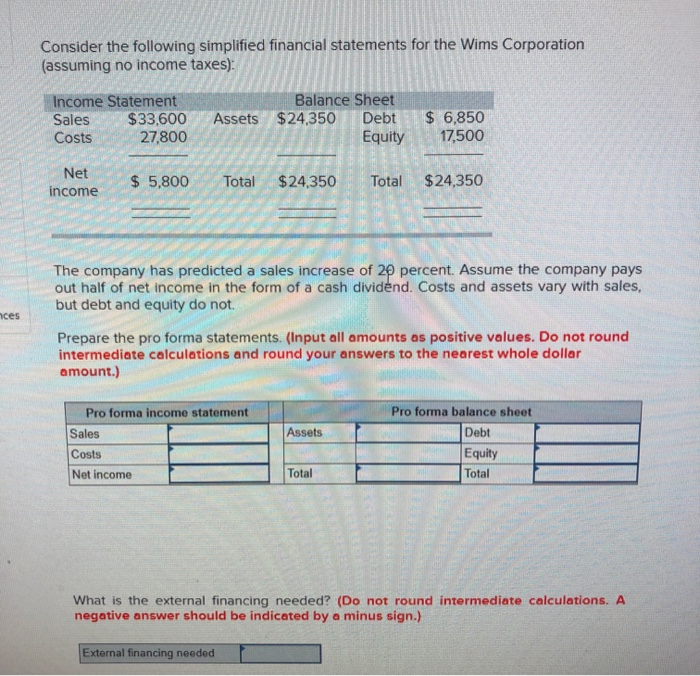

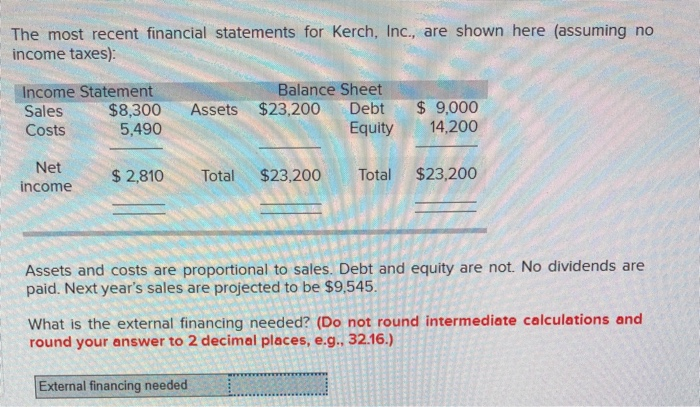

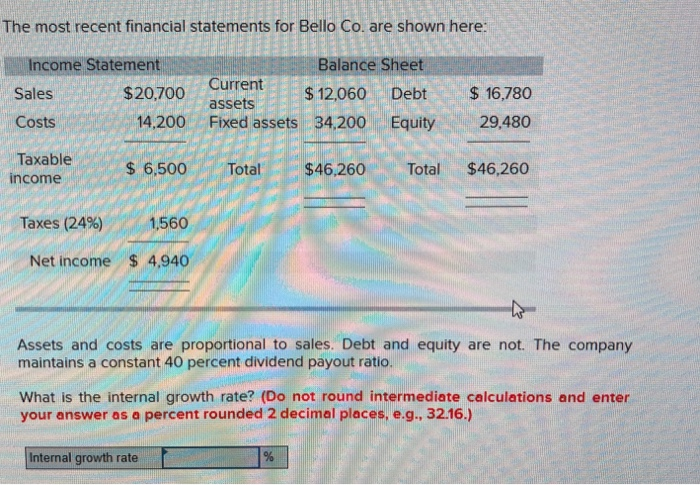

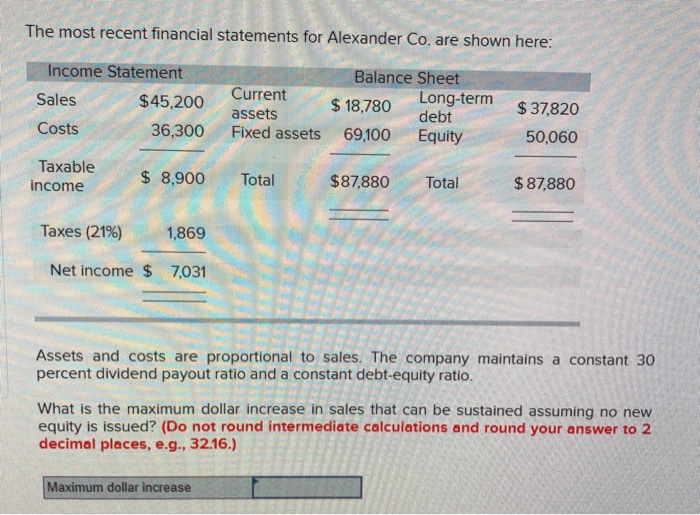

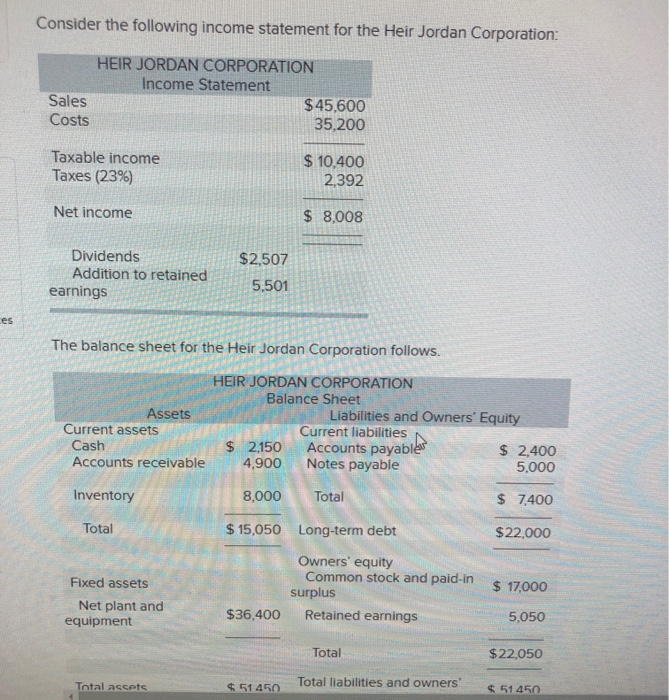

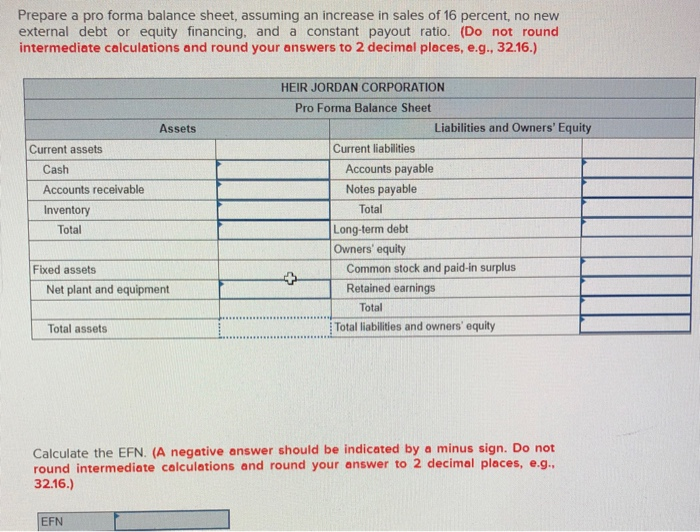

Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Sales $47,300 Costs 40,670 Balance Sheet Assets $24.900 Debt $ 6,900 Equity 18,000 Net income $ 6,630 Total $24.900 Total $24.900 The company has predicted a sales increase of 20 percent. It has predicted that every item on the balance sheet will increase by 20 percent as well. Create the pro forma statements and reconcile them. (Input all answers as positive values. Do not round intermediate calculations.) Assets $ Pro forma income statement Sales $ 56,760 Costs 48,804 Net income $ 7,956 Pro forma balance sheet 29,880 Debt Equity 29,880Total 8,280 21,600 29.880 $ What is the plug variable? The plug variable dividends paid in the amount of Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Sales $33,600 Costs 27,800 Assets Balance Sheet $24,350 Debt Equity $ 6,850 17,500 Net income $ 5,800 Total $24,350 Total $24,350 The company has predicted a sales increase of 20 percent. Assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not nces Prepare the pro forma statements. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.) Assets Pro forma income statement Sales Costs Net income Pro forma balance sheet Debt Equity Total Total What is the external financing needed? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) External financing needed The most recent financial statements for Kerch, Inc., are shown here (assuming no income taxes): Income Statement Sales $8,300 Costs 5,490 Assets Balance Sheet $23,200 Debt Equity $ 9,000 14,200 Net income $ 2,810 Total $23,200 Total $23,200 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $9,545. What is the external financing needed? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) External financing needed The most recent financial statements for Bello Co. are shown here: Income Statement Sales $20700 Costs 14,200 Balance Sheet Current $12.060 Debt assets Fixed assets 34,200 Equity $ 16,780 29,480 Taxable income $ 6,500 Total $46,260 Total $46,260 Taxes (24%) 1560 Net income $ 4,940 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. What is the internal growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.) Internal growth rate The most recent financial statements for Alexander Co. are shown here: Balance Sheet Income Statement Sales $45,200 Costs 36,300 Current assets $18,780 Long-term Fixed assets $ 37,820 50,060 debt Equity 69,100 Taxable income $ 8,900 Total $87,880 Total $ 87,880 Taxes (21%) 1,869 Net income $ 7,031 Assets and costs are proportional to sales. The company maintains a constant 30 percent dividend payout ratio and a constant debt-equity ratio. What is the maximum dollar increase in sales that can be sustained assuming no new equity is issued? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Maximum dollar increase Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement Sales $45,600 Costs 35,200 Taxable income Taxes (23%) $ 10,400 2,392 Net income $ 8,008 Dividends Addition to retained earnings $2,507 5,501 The balance sheet for the Heir Jordan Corporation follows. HEIR JORDAN CORPORATION Balance Sheet Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 2,150 Accounts payable $ 2,400 Accounts receivable 4,900 Notes payable 5,000 Inventory 8,000 Total $ 7,400 Total $ 15,050 Long-term debt $22,000 Owners' equity Common stock and paid-in surplus Retained earnings Fixed assets Net plant and equipment $ 17,000 $36,400 5,050 Total $22,050 Total assets $51450 Total liabilities and owners $ 51450 Prepare a pro forma balance sheet, assuming an increase in sales of 16 percent, no new external debt or equity financing, and a constant payout ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Assets Current assets Cash Accounts receivable Inventory Total HEIR JORDAN CORPORATION Pro Forma Balance Sheet Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity Fixed assets Net plant and equipment Total assets Calculate the EFN. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) EFNI