Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following situation You are requested to make an offer today (April 2022) to a client for physical delivery of 25 tonnes of

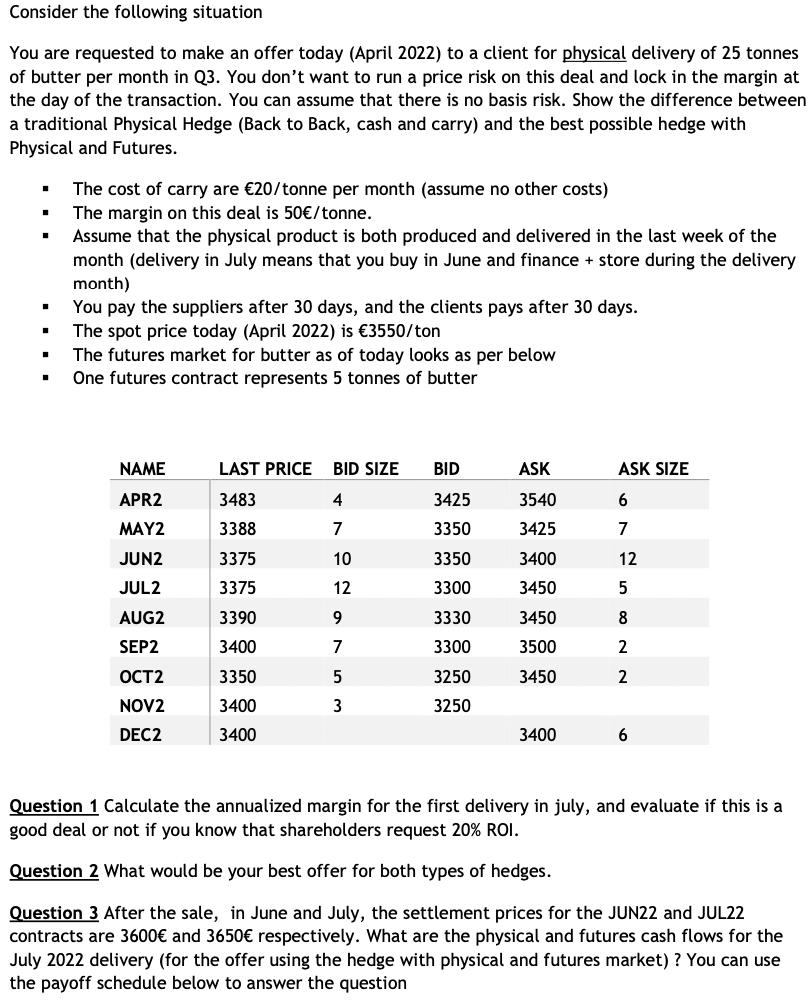

Consider the following situation You are requested to make an offer today (April 2022) to a client for physical delivery of 25 tonnes of butter per month in Q3. You don't want to run a price risk on this deal and lock in the margin at the day of the transaction. You can assume that there is no basis risk. Show the difference between a traditional Physical Hedge (Back to Back, cash and carry) and the best possible hedge with Physical and Futures. I The cost of carry are 20/tonne per month (assume no other costs) The margin on this deal is 50 / tonne. Assume that the physical product is both produced and delivered in the last week of the month (delivery in July means that you buy in June and finance + store during the delivery month) You pay the suppliers after 30 days, and the clients pays after 30 days. The spot price today (April 2022) is 3550/ton The futures market for butter as of today looks as per below One futures contract represents 5 tonnes of butter NAME APR2 MAY2 JUN2 JUL2 AUG2 SEP2 OCT2 NOV2 DEC2 LAST PRICE BID SIZE 3483 4 3388 7 3375 10 3375 12 3390 9 3400 7 3350 5 3400 3 3400 BID 3425 3350 3350 3300 3330 3300 3250 3250 ASK 3540 3425 3400 3450 3450 3500 3450 3400 ASK SIZE 6 7 12 5 8 2 2 6 Question 1 Calculate the annualized margin for the first delivery in july, and evaluate if this is a good deal or not if you know that shareholders request 20% ROI. Question 2 What would be your best offer for both types of hedges. Question 3 After the sale, in June and July, the settlement prices for the JUN22 and JUL22 contracts are 3600 and 3650 respectively. What are the physical and futures cash flows for the July 2022 delivery (for the offer using the hedge with physical and futures market)? You can use the payoff schedule below to answer the question

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To calculate the annualized margin for the first delivery in Julywe need to first calculate the total margin for the deliveryThis is done b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started