Question

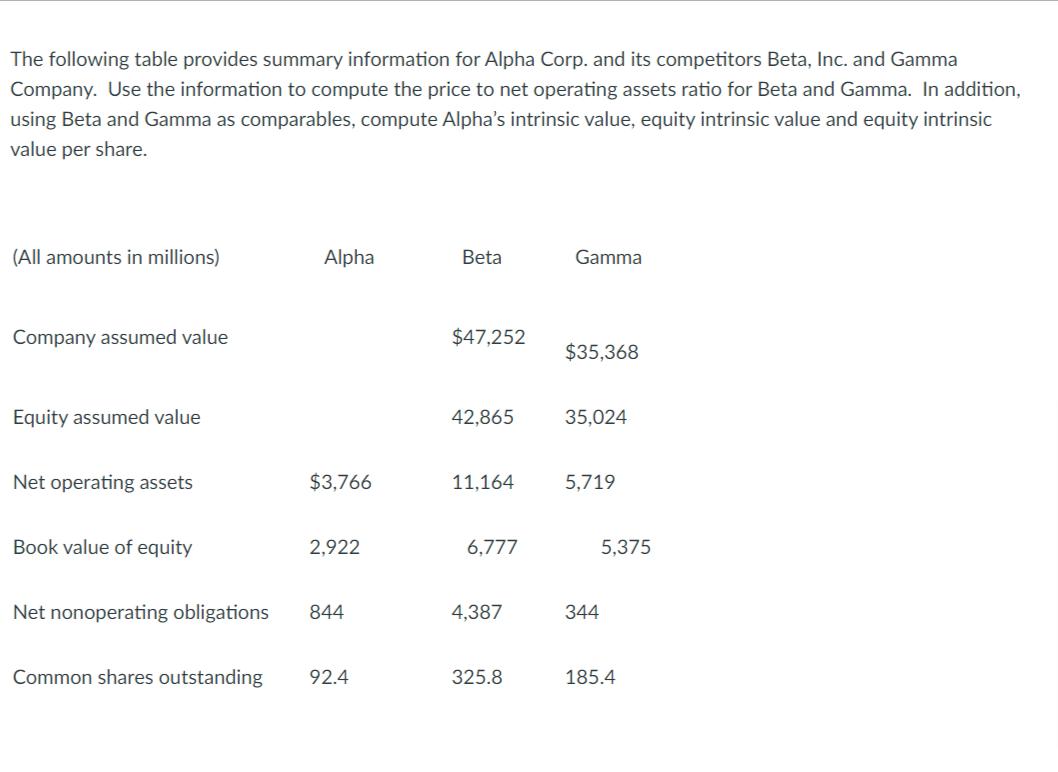

The following table provides summary information for Alpha Corp. and its competitors Beta, Inc. and Gamma Company. Use the information to compute the price

The following table provides summary information for Alpha Corp. and its competitors Beta, Inc. and Gamma Company. Use the information to compute the price to net operating assets ratio for Beta and Gamma. In addition, using Beta and Gamma as comparables, compute Alpha's intrinsic value, equity intrinsic value and equity intrinsic value per share. (All amounts in millions) Company assumed value Equity assumed value Net operating assets Book value of equity Net nonoperating obligations Alpha $3,766 2,922 844 Common shares outstanding 92.4 Beta $47,252 42,865 11,164 6,777 4,387 325.8 Gamma $35,368 35,024 5,719 344 5.375 185.4

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Solution ACalculation of price to net operating assets ratio Price to net oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting in an Economic Context

Authors: Jamie Pratt

8th Edition

9781118139424, 9781118139431, 470635290, 1118139429, 1118139437, 978-0470635292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App