Question

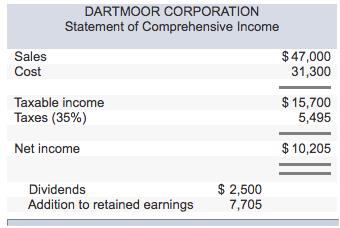

Consider the following statement of comprehensive income for the Dartmoor Corporation: The statement of financial position for the Dartmoor Corporation follows. Based on this information

Consider the following statement of comprehensive income for the Dartmoor Corporation:

The statement of financial position for the Dartmoor Corporation follows. Based on this information and the statement of comprehensive income, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not.

DARTMOOR CORPORATION Statement of Comprehensive Income Sales Cost $47,000 31,300 $ 15,700 5,495 Taxable income Taxes (35%) Net income $ 10,205 Dividends Addition to retained earnings $ 2,500 7,705

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting The Impact On Decision Makers

Authors: Gary A. Porter, Curtis L. Norton

10th Edition

1305793196, 978-1305793194

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App