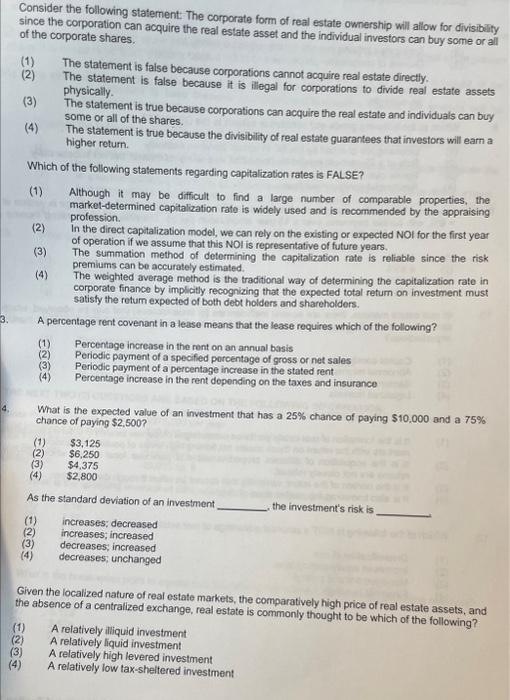

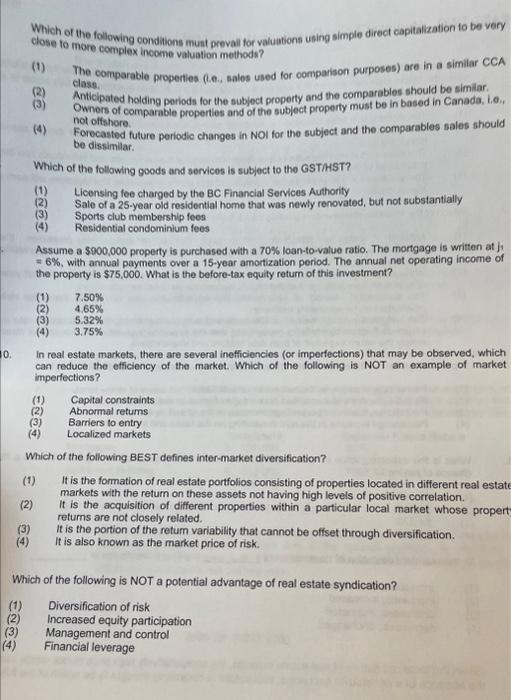

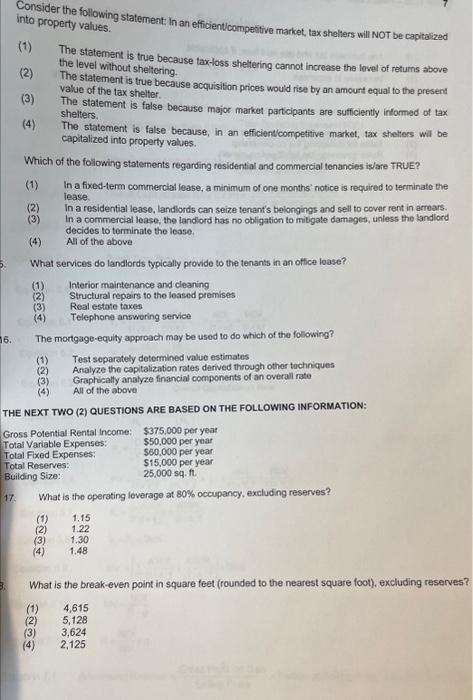

Consider the following statement: The corporate form of real estate ownership will allow for divisibility since the corporation can acquire the real estate asset and the individual investors can buy some or all of the corporate shares. (1) The statement is false because corporations cannot acquire real estate directly. (2) The statement is false because it is illegal for corporations to divide real estate assets (3) physically. (3) The statement is true because corporations can acquire the real estate and individuals can buy (4) some or all of the shares. The statement is true because the divisibility of real estate guarantees that investors will earn a higher return. Which of the following statements regarding capitalization rates is FALSE? (1) Although it may be difficult to find a large number of comparable properties, the market-determined capitalization rate is widely used and is recommended by the appraising profession. (2) In the direct capitalization model, we can rely on the existing or expected NOI for the first year of operation if we assume that this NOl is representative of future years. (3) The summation method of determining the capitalization rate is reliable since the risk premiums can be accurately estimated. (4) The weighted average method is the traditional way of determining the capitalization rate in corporate finance by implicity recognizing that the expocted total retum on investment must satisty the rotum expected of both debt holders and shareholders. A percentage rent covenant in a lease means that the lease requires which of the following? (1) Percentage increase in the rent on an annual basis (2) Periodic payment of a specifed porcentage of gross or net sales (3) Periodic payment of a percentage increase in the stated rent (4) Percentage increase in the rent dopending on the taxes and insurance 4. What is the expected value of an investment that has a 25% chance of paying $10,000 and a 75% chance of paying $2,500 ? (1) $3,125 (2) $6,250 (3) $4,375 (4) $2,800 As the standard deviation of an investment (1) increases; decreased (2) increases; increased (3) decreases; increased (4) decreases, unchanged Given the localized nature of real estate markets, the comparatively high price of real estate assets, and the absence of a centralized exchange, real estate is commonly thought to be which of the following? (1) A relatively illiquid investment (2) A relatively liquid investment (3) A relatively high levered investment (4) A relatively low tax-sheitered investment Which of the following conditions munt prevall for valuations uning simple direct capitalization to be very close to more complex income valuation methods? (1) The comparable properties (i.e., sales used for comparison purposes) are in a similar CCA clasi. (2) Anticlpated holding poriods for the subject property and the comparabies should be similar. (3) Owners of comparable properties and of the subject property must be in based in Canada, i.e.. (4) not olfshore. Forecasted future periodic changes in NOI for the subject and the comparables sales should be dissimilar. Which of the following goods and services is subject to the GSTMST? (1) Licensing fee charged by the BC Financial Services Authority (2) Sale of a 25-year old residential home that was newly renovated, but not substantially (3) Sports club membership fees. (4) Residential condominium fees Assume a $900,000 property is purchased with a 70% loan-to-value ratio. The mortgage is written at j. =6%, with annual payments over a 15 -year amortization period. The annual net operating income of the property is $75,000. What is the before-tax equity retum of this investment? (1) 7.50% (2) 4.65% (3) 5.32% (4) 3.75% 10. In real estate markets, there are several inefficiencies (or imperfections) that may be observed, which can reduce the efficiency of the market. Which of the following is NOT an example of market imperfections? (1) Capital constraints (2) Abnormal retums (3) Bamers to entry (4) Localized markets Which of the following BEST defines inter-market diversification? (1) It is the formation of real estate portfolios consisting of properties located in different real estate markets with the retum on these assets not having high levels of positive correlation. (2) It is the acquisition of different properties within a particular local market whose propert returns are not closely related. (3) It is the portion of the retum variability that cannot be offset through diversification. (4) It is also known as the market price of risk. Which of the following is NOT a potential advantage of real estate syndication? (1) Diversification of risk (2) Increased equity participation (3) Management and control (4) Financial leverage Consider the following statement, In an efficientlicompetitive market, tax sheliers will NOT be capitalized into property values. (1) The statement is true because tax-loss sheltering cannot increase the level of retums above (2) the level without sheltering. (2) The statement is true because acquisition prices would rise by an amount equal to the present (3) value of the tax shelter. The statement is false because major market partcipants are sutficiently informed of tax shelters. (4) The statement is false because, in an efficientcompefitive market, tax shelters wil be capitalized into property values. Which of the following statements regarding residential and commercial tenancies is/are TRUE? (1) In a fixed-term commercial lease, a minimum of one months' notice is required to terminate the lease. (2) In a residential lease, landlonds can seize tenant's belongings and sell to covar rent in arroars. (3) In a commercial lease, the landlord has no obligation to mitgate damages, unless the landlord decides to terminate the lease. (4) All of the above What services do landlords typically provide to the tenants in an office loase? (1) Interior maintenance and cleaning (2) Structural repairs to the leased premises (3) Real estate taxes (4) Telephone answering service 6. The mortgage-equity approach may be used to do which of the following? (1) Test separately determined value estimates (2) Analyze the capitalization rates derived through other tochiques (3) Graphically analyze financial components of an overall rate (4) All of the above THE NEXT TWO (2) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: 17. What is the operating leverage at 80% occupancy, excluding reserves? (1) 1.15 (2) 1.22 (3) 1.30 (4) 1.48 What is the break-even point in square feet (rounded to the nearest square foot), excluding reserves? (1) 4,615 (2) 5,128 (3) 3,624 (4) 2,125