Question

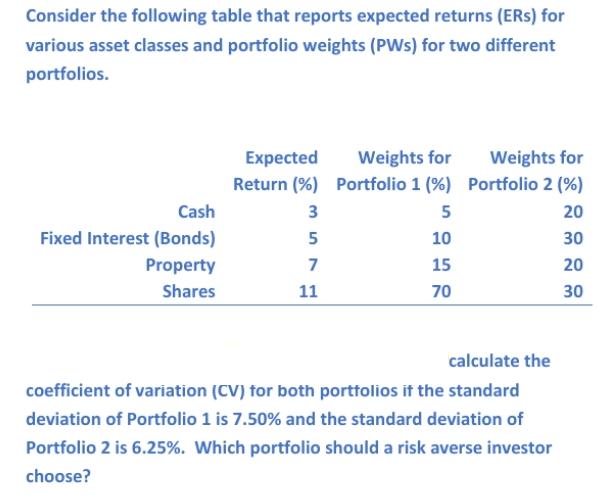

Consider the following table that reports expected returns (ERS) for various asset classes and portfolio weights (PWs) for two different portfolios. Cash Fixed Interest

Consider the following table that reports expected returns (ERS) for various asset classes and portfolio weights (PWs) for two different portfolios. Cash Fixed Interest (Bonds) Property Shares Expected Return (%) 3 5 7 11 Weights for Portfolio 1 (%) 5 10 15 70 Weights for Portfolio 2 (%) 20 30 20 30 calculate the coefficient of variation (CV) for both portfolios if the standard deviation of Portfolio 1 is 7.50% and the standard deviation of Portfolio 2 is 6.25%. Which portfolio should a risk averse investor choose?

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The coefficient of variation CV is a measure of the relative risk of an investment or portfolio It i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

13th Edition

978-0134083308, 013408330X

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App