Question

Consider the following tables for four EM equity funds priced in US dollars. You can also invest in the MSCI EM index and in 1-year

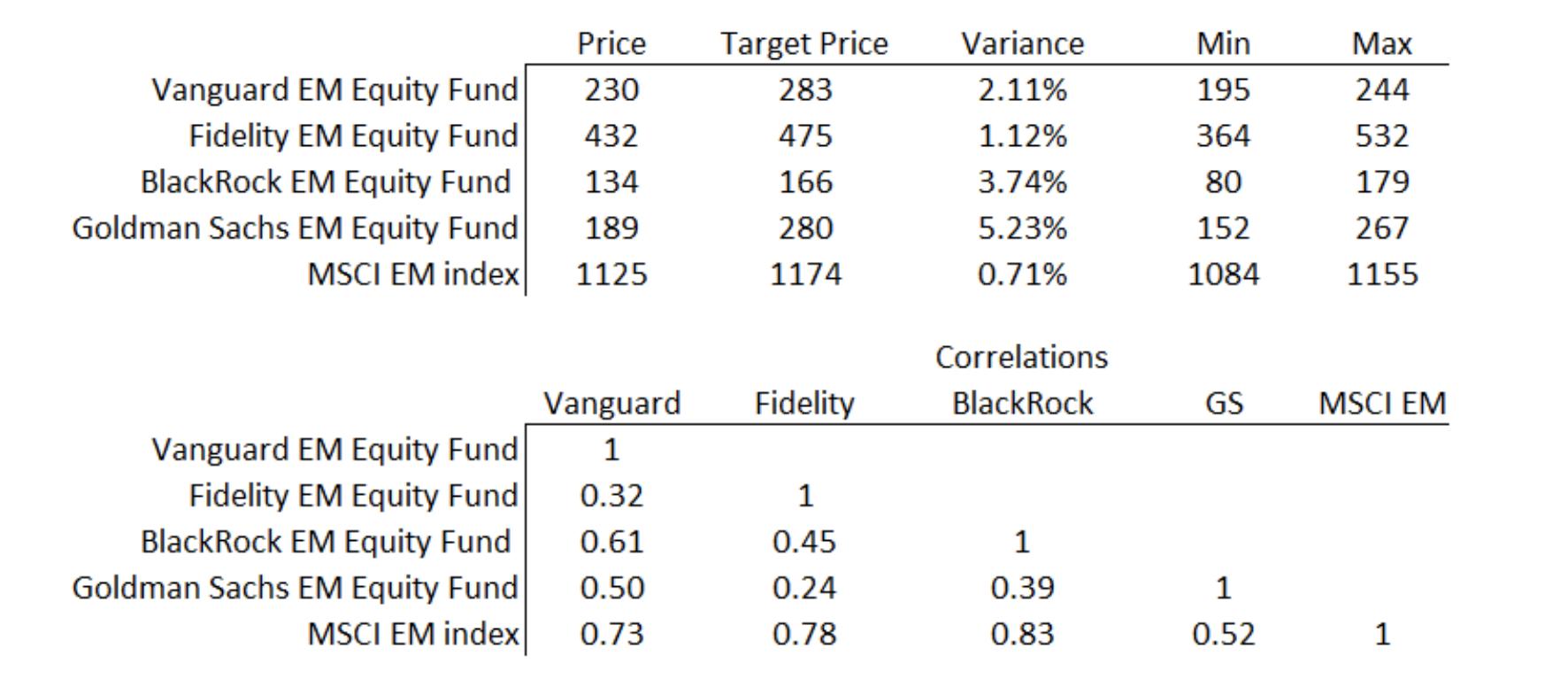

Consider the following tables for four EM equity funds priced in US dollars. You can also invest in the MSCI EM index and in 1-year Treasury bonds whose yield is 1.5%. The table contains the average target price 1 year from now predicted by analysts, the current price and the historical return variance, price minimum and maximum during the last year.

(i) Assume you can invest in only one fund. Which one would you prefer to hold in combination with T-bills and why, based on all information given?

(ii) Assume you can now invest in all funds and the risk-free asset. Construct 3 portfolio of 3, 4 and 5 assets each (“asset” includes the funds, the index and the bond). Justify your choice of assets in each case and explain if and why any of those portfolio is more preferable than the previous choice

Price 230 432 134 189 MSCI EM index 1125 Vanguard EM Equity Fund Fidelity EM Equity Fund BlackRock EM Equity Fund Goldman Sachs EM Equity Fund Vanguard 1 0.32 0.61 0.50 MSCI EM index 0.73 Vanguard EM Equity Fund Fidelity EM Equity Fund BlackRock EM Equity Fund Goldman Sachs EM Equity Fund Target Price 283 475 166 280 1174 Fidelity 1 0.45 0.24 0.78 Variance 2.11% 1.12% 3.74% 5.23% 0.71% Correlations BlackRock 1 0.39 0.83 Min 195 364 80 152 1084 GS 1 0.52 Max 244 532 179 267 1155 MSCI EM 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To make an informed decision on which equity fund to hold in combination with Tbills we need to evaluate the funds based on potential return and risk variance i The potential return can be approximate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started