Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following three bonds. Bond A is a 1-year zero-coupon bond. Bond B is a 3- year bond that pays 150 in coupons

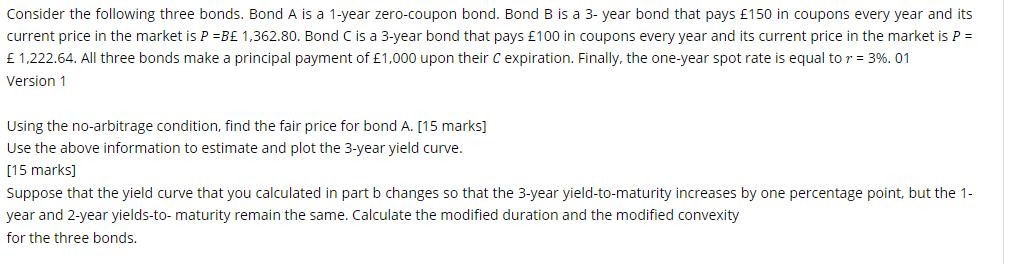

Consider the following three bonds. Bond A is a 1-year zero-coupon bond. Bond B is a 3- year bond that pays 150 in coupons every year and its current price in the market is P =BE 1,362.80. Bond C is a 3-year bond that pays 100 in coupons every year and its current price in the market is P = 1,222.64. All three bonds make a principal payment of 1,000 upon their C expiration. Finally, the one-year spot rate is equal to r = 3%. 01 Version 1 Using the no-arbitrage condition, find the fair price for bond A. [15 marks] Use the above information to estimate and plot the 3-year yield curve. [15 marks] Suppose that the yield curve that you calculated in part b changes so that the 3-year yield-to-maturity increases by one percentage point, but the 1- year and 2-year yields-to-maturity remain the same. Calculate the modified duration and the modified convexity for the three bonds.

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Part A Noarbitrage condition to find fair price for bond A The noarbitrage condi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started