Question

2. Consider the following three models which a researcher can use to model stock market prices: Yt Yt-1 + Ut Yt = 0.5yt-1 +

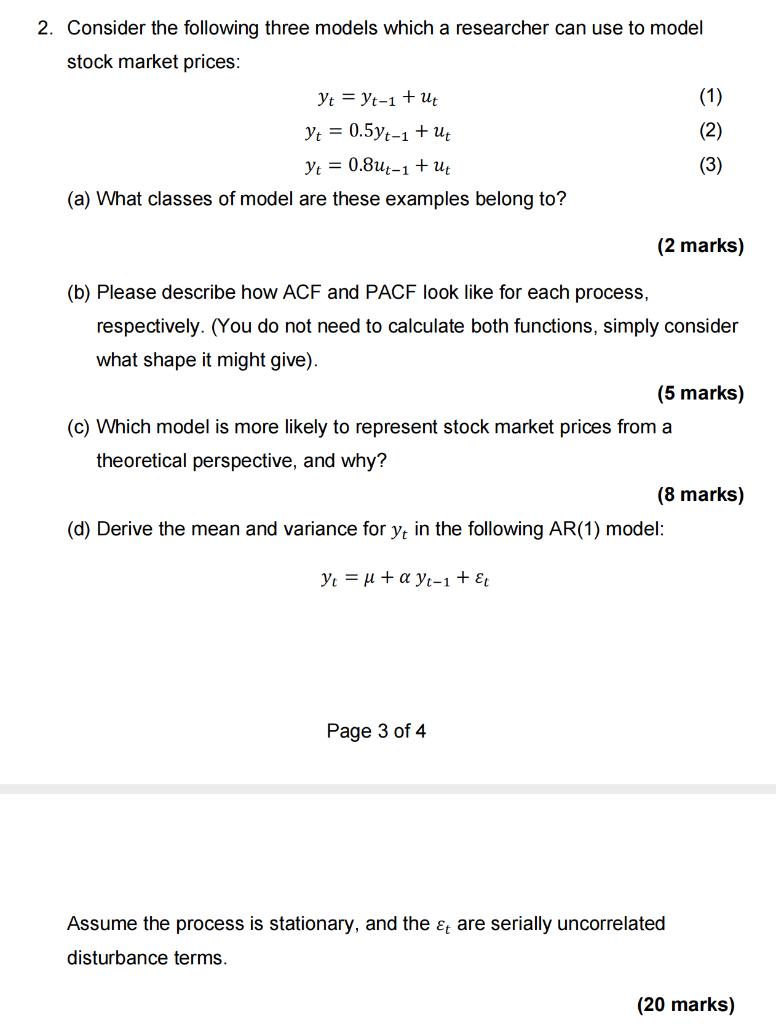

2. Consider the following three models which a researcher can use to model stock market prices: Yt Yt-1 + Ut Yt = 0.5yt-1 + Ut Yt = 0.8ut-1 + Ut (a) What classes of model are these examples belong to? (2 marks) (b) Please describe how ACF and PACF look like for each process, respectively. (You do not need to calculate both functions, simply consider what shape it might give). (c) Which model is more likely to represent stock market prices from a theoretical perspective, and why? Page 3 of 4 (1) (2) (3) (5 marks) (d) Derive the mean and variance for y, in the following AR(1) model: Y = + ayt-1 + Et (8 marks) Assume the process is stationary, and the & are serially uncorrelated disturbance terms. (20 marks)

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Chemistry The Central Science

Authors: Theodore Brown, Eugene LeMay, Bruce Bursten, Catherine Murphy, Patrick Woodward

12th edition

321696727, 978-0132175081, 978-0321696724

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App