Answered step by step

Verified Expert Solution

Question

1 Approved Answer

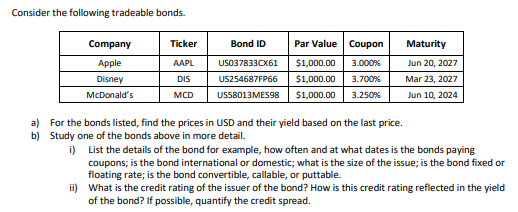

Consider the following tradeable bonds. a) For the bonds listed, find the prices in USD and their yield based on the last price. b) Study

Consider the following tradeable bonds. a) For the bonds listed, find the prices in USD and their yield based on the last price. b) Study one of the bonds above in more detail. i) List the details of the bond for example, how often and at what dates is the bonds paying coupons; is the bond international or domestic; what is the size of the issue; is the bond fixed or floating rate; is the bond convertible, callable, or puttable. ii) What is the credit rating of the issuer of the bond? How is this credit rating reflected in the yield of the bond? If possible, quantify the credit spread. To do this, follow these steps. First, approximate the maturity of the bond in years. Then find the yield of the US Treasury note with the same maturity. If necessary, take the average of two bonds. For example, if your bond matures in 4 years, use the 3-year and 5 -year Treasuries

Consider the following tradeable bonds. a) For the bonds listed, find the prices in USD and their yield based on the last price. b) Study one of the bonds above in more detail. i) List the details of the bond for example, how often and at what dates is the bonds paying coupons; is the bond international or domestic; what is the size of the issue; is the bond fixed or floating rate; is the bond convertible, callable, or puttable. ii) What is the credit rating of the issuer of the bond? How is this credit rating reflected in the yield of the bond? If possible, quantify the credit spread. To do this, follow these steps. First, approximate the maturity of the bond in years. Then find the yield of the US Treasury note with the same maturity. If necessary, take the average of two bonds. For example, if your bond matures in 4 years, use the 3-year and 5 -year Treasuries Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started